Market

32-year-old entrepreneur raises $20 million to invest in women-owned businesses

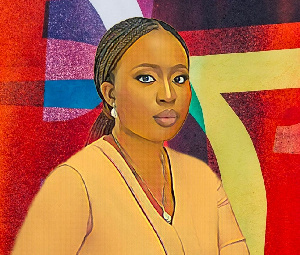

Adesuwa Okunbo Rhodes is making waves in the investment world as the founder of Aruwa Capital Management, a female-founded and led growth-equity impact investment company based in Lagos, Nigeria.

At just 32 years old, Rhodes has already achieved impressive success, including becoming the first female solo general partner to raise more than $10 million in an institutional first fund in Nigeria.

Just two weeks ago, she made headlines as the youngest solo general partner to raise a $20-million fund in Nigeria when her firm, Aruwa Capital, surpassed its $20-million target in its first institutional fund, which was led by the Visa Foundation and the MasterCard Foundation Africa Growth Fund.

But Rhodes’ achievements go beyond just raising capital. She is one of the few African women to create an investment fund and is possibly the youngest to do so. Through Aruwa Capital, she has worked to create one of the few women-owned and led early-stage growth equity funds on the continent, focused on investing in untapped investment opportunities in West Africa in the small to lower mid-market.

In addition to making investments in several businesses, including healthcare firms and fintech start-ups, Aruwa Capital plans to use the $20 million fund to invest between $500,000 and $2.5 million in businesses run by and geared toward women in West Africa.

Her dedication to closing the investment gap affecting women-owned businesses in Africa extends beyond just her work with Aruwa Capital. Prior to starting the company, she was a partner and managing Director at Syntaxis Africa, a member of Syntaxis Capital, a leading provider of growth credit for mid- to lower mid-market companies.

During her time as an Investment Banker at J.P. Morgan, Rhodes executed $2 billion of M&A transactions in the UK and United States across the industrial, consumer, and healthcare, sectors, and $3.6 billion of structured credit transactions across emerging markets, including Africa.

It’s clear that her experience and track record make her a valuable asset in the investment world. But her efforts to close the funding gap for women-owned businesses in Africa and use her skills to make a positive impact in society have not gone unrecognized. She has been named one of the top 35 women moving Africa forward in 2020, one of the top 100 global leaders combining profit and purpose in 2021, and one of the top 50 inspiring women in Nigeria in 2022.

Rhodes’ success with Aruwa Capital highlights the importance of increasing the number of women-led investment firms in order to close the funding gap for women-owned businesses.

It also showcases the potential for local capital to play a crucial role in supporting and investing in these businesses. As one of the youngest female private equity fund managers in Africa, she is leading the way in breaking down barriers and paving the way for other women in the industry.

Source: billionaires.africa

-

Lifestyle4 weeks ago

Lifestyle4 weeks agoRoad Safety Authority narrates how buttocks causes road accident

-

GENERAL NEWS1 month ago

GENERAL NEWS1 month agoWhy 15 police officers stormed Owusu Bempah’s church – Kumchacha narrates

-

GENERAL NEWS4 weeks ago

GENERAL NEWS4 weeks agoWatch how Ibrahim Mahama rode Honda superbike to pay last respects to late friend

-

GENERAL NEWS1 month ago

GENERAL NEWS1 month agoHow Offinso residents storm destooled queen mother’s house, demand for new chief

-

South Africa News1 month ago

South Africa News1 month agoWoman thrown out of a speeding taxi while on her way to work

-

GENERAL NEWS2 weeks ago

GENERAL NEWS2 weeks agoDeadly clash between youth and navy personnel results in two deaths at Tema Manhean

-

SHOWBIZ KONKONSAH2 weeks ago

SHOWBIZ KONKONSAH2 weeks agoJunior Pope’s Death: Video of John Dumelo refusing to join canoe for movie shoot over safety concerns resurfaces

-

News Africa2 months ago

News Africa2 months ago‘Satanically dubious’ – SCOAN releases statement on BBC’s report about TB Joshua, church