Finance

Court orders government to respond to Nduom’s suit on behalf of contractors

The High Court has struck out an application by the Attorney General seeking to stop State Agencies from paying monies owed some contractors to Ghana Growth Fund.

Ghana Growth Fund Company Limited (GGFC), which is a subsidiary of Groupe Nduom, sued the Attorney General’s Office (AG), Finance Ministry, Road Ministry and Reggio Limited (one of the contractors) for monies owed to it.

The monies, according to the suit are principal and interests on various loan amounts that GGFC had advanced to road construction firms.

The suit also mentioned that the construction firm has assigned the contract sums to GGFC following which the state agencies have made several payments to the company.

The state agencies, however, stopped making payments along the way, forcing GGFC to issue a writ to enforce the payments.

The court after hearing the arguments of the AG on why the case should be dismissed declined the request of the AG and struck it out. The presiding judge Justice Samuel Asiedu further ordered the state to open their defense.

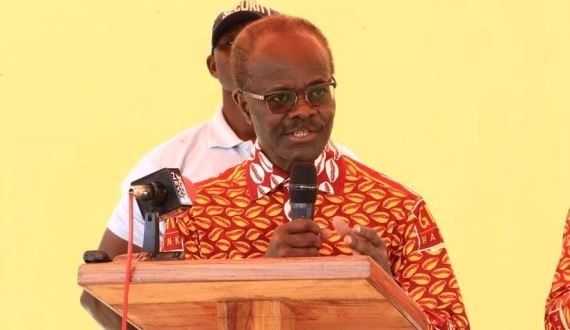

Ndoum’s court battles

The GN subsidiary in July, 2019, filed a number of cases in court against government praying the court to compel state agencies to pay the outstanding debt as well as interest that may have accrued on monies owed contractors it has prefinanced to undertake government work.

Gold Coast Securities and GN Bank, all subsidiaries of the Groupe Nduom, have faced a protracted liquidity challenge which has seen people who lodged funds with the two institutions unable to access them.

Sources at the two institutions have always insisted that their challenges have stemmed out from the government’s inability to honour payments to contractors who were funded with cash from clients of these companies.

The GN subsidiaries are said to have advanced more than GHS2 billion to various contractors and the Groupe, having tried all means possible to retrieve the outstanding debt, is now seeking redress in court.

Source: www.citibusinessnews.com

-

Lifestyle4 weeks ago

Lifestyle4 weeks agoRoad Safety Authority narrates how buttocks causes road accident

-

GENERAL NEWS1 month ago

GENERAL NEWS1 month agoWhy 15 police officers stormed Owusu Bempah’s church – Kumchacha narrates

-

GENERAL NEWS4 weeks ago

GENERAL NEWS4 weeks agoWatch how Ibrahim Mahama rode Honda superbike to pay last respects to late friend

-

GENERAL NEWS1 month ago

GENERAL NEWS1 month agoHow Offinso residents storm destooled queen mother’s house, demand for new chief

-

South Africa News1 month ago

South Africa News1 month agoWoman thrown out of a speeding taxi while on her way to work

-

GENERAL NEWS2 weeks ago

GENERAL NEWS2 weeks agoDeadly clash between youth and navy personnel results in two deaths at Tema Manhean

-

SHOWBIZ KONKONSAH2 weeks ago

SHOWBIZ KONKONSAH2 weeks agoJunior Pope’s Death: Video of John Dumelo refusing to join canoe for movie shoot over safety concerns resurfaces

-

News Africa2 months ago

News Africa2 months ago‘Satanically dubious’ – SCOAN releases statement on BBC’s report about TB Joshua, church