Investing for Women: Strategies That Work

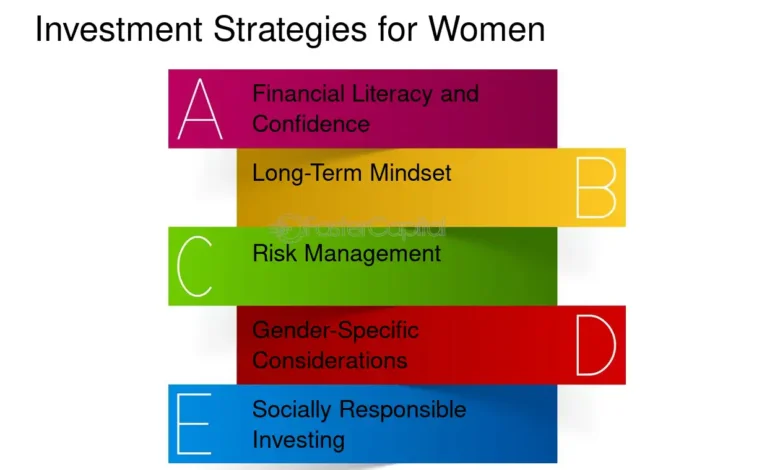

Women are increasingly taking control of their financial futures, yet they still face unique challenges in the world of investing. From gender pay gaps to longer life expectancies and time away from the workforce due to caregiving, women must often work harder to grow their wealth. The good news? Investing isn’t just for the wealthy or Wall Street experts—and there are effective strategies tailored to empower women at every stage of life.

This article explores why investing matters for women and outlines practical, proven strategies to build long-term wealth and financial security.

Why Women Should Prioritize Investing

Despite earning less on average, women tend to be better long-term investors than men, according to several studies. They trade less, are more consistent with their investment strategy, and take fewer high-risk bets. However, many women hesitate to start investing due to a lack of confidence, financial education, or time.

Here’s why it matters:

-

Women live longer: Women typically live 5–7 years longer than men, requiring more retirement savings.

-

Income gaps: Women earn and invest less over their lifetime due to wage disparities and time taken off for caregiving.

-

Inflation: Keeping money in a savings account erodes its value over time due to inflation. Investing helps money grow faster than inflation.

1. Start Early, Even with Small Amounts

Time is one of your most powerful tools. Thanks to compound interest, investing small amounts consistently over time can yield impressive results. For example:

-

Investing $100/month for 30 years at 8% average return could grow to over $135,000.

-

Starting in your 20s or 30s gives you decades of growth—so start now, even if it’s just a little.

Tip: Automate your investments monthly to stay consistent without overthinking.

2. Use Diversified Investment Vehicles

Diversification spreads your money across different types of investments—like stocks, bonds, and real estate—to reduce risk.

Great Options for Beginners:

-

Index Funds: These track the performance of the entire stock market or a specific sector (e.g., S&P 500). They’re low-cost and less risky than picking individual stocks.

-

ETFs (Exchange-Traded Funds): Similar to index funds but can be traded like stocks. Great for easy access and variety.

-

Robo-Advisors: Automated platforms (like Wealthfront or Ellevest) that build and manage a diversified portfolio for you, often based on your goals and risk tolerance.

3. Invest in What You Understand

While diversification is key, it’s also smart to invest in sectors or companies you’re familiar with.

Women often excel at this strategy. From tech apps to healthcare, fashion, and consumer brands, women can tap into industries they naturally engage with or follow closely.

Example: If you use a product like Apple or shop at Target, and you understand the brand’s appeal, consider looking into their stock as a potential investment.

4. Set Clear Goals and Risk Tolerance

Knowing why you’re investing is just as important as how. Are you saving for:

-

Retirement?

-

A house?

-

Your children’s education?

-

Financial independence?

Each goal has a different timeline and risk profile. Long-term goals (10+ years) allow for more stock market exposure, while short-term goals should lean toward low-risk options like bonds or high-yield savings.

Risk Tip: Don’t let fear stop you. Markets go up and down, but historically, they trend upward over time.

5. Build a Financial Support System

Talking about money is still a taboo in many cultures, especially for women. But discussing finances with friends, mentors, or a financial advisor can provide support, confidence, and insight.

Ways to Build Support:

-

Join a women-focused investing group or online community.

-

Follow female financial educators on YouTube or Instagram.

-

Consider consulting a fee-only financial planner who acts in your best interest.

Examples of platforms for women:

-

Ellevest – Investment platform built by women, for women.

-

Female Invest – Offers investing education specifically for women.

-

HerMoney – A financial media company focused on women’s wealth.

6. Prioritize Financial Literacy

Investing without understanding the basics can feel intimidating. The good news is you don’t need to become an expert overnight.

Start with these free tools:

-

Books: “Smart Women Finish Rich” by David Bach, “Clever Girl Finance” by Bola Sokunbi

-

Podcasts: HerMoney with Jean Chatzky, The Financial Feminist

-

Courses: Look for beginner investing courses on Coursera, Udemy, or Khan Academy.

Knowledge is power—and peace of mind.

Investing is one of the most powerful tools women can use to build long-term wealth, independence, and security. Whether you’re just starting your career or planning for retirement, the key is to start now, stay consistent, and educate yourself along the way.

Remember: You don’t need to be rich to start investing. But you do need to start to become rich.

Source: Thepressradio.com