SEC’s statement on Blackshield misleading – Groupe Nduom

Groupe Nduom Limited has reacted to the Securities and Exchange Commission’s revocation of licenses of 53 fund management companies, which includes Blackshield Capital Management (formerly Gold Coast Fund Management).

According to Groupe Nduom, the entity representing the interests of the majority shareholders and founders of Blackshield, the SEC’s assertion that 99.41 per cent of its funds were placed in one investment vehicle, for instance, was “misleading and/or untrue.”

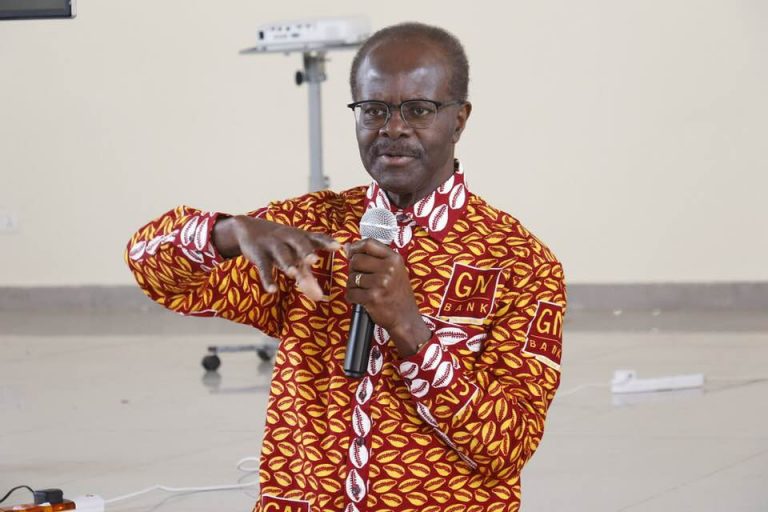

In a statement signed and issued by the Chairman and CEO of Groupe Nduom, Dr Papa Kwesi Nduom in reaction to the revocation of the license, Groupe Nduom said it will “continue to pursue legal action to collect funds owed in settlement of Blackshield’s client liabilities.”

It said it was disappointed that the SEC took the revocation of license action without responding to the numerous requests to assist Blackshield in retrieving funds owed by various government of Ghana entities, as well as reviewing its [Blackshield] plans to migrate customers into a private-sector solution to Blackshield’s liquidity problem.

Why Blackshield’s license was revoked

Blackshield Capital Management Limited (formerly Gold Coast Fund Management Limited), was incorporated on August 12, 1993 and was licensed by the SEC on August 12, 2013.

On July 11, 2019, the firm changed its name to Blackshield Capital Management Limited.

According to the SEC, it has had a number of engagements with Blackshield including Hearings pursuant to section 19 of Act 929 and decisions have been issued by the SEC against Blackshield with directives to take steps to comply and resolve its regulatory infractions, all to no avail.

The SEC explained that the specific issues that led to the revocation of Blackshield’s license included failure to honour clients’ redemption requests, placement of client funds with related parties without proper due diligence and the requisite standard of professional conduct contrary to the Commission’s Compliance Manual for Broker-Dealers, Investment Advisers and Representatives 2008.

It said according to Blackshield’s 2nd Quarter 2018 Placement Report, 99.41 per cent of it’s funds under management had been placed with an unregulated related entity, Ghana Growth Fund Limited (now Gold Coast Advisors Limited).

It added that Blackshield failed to adhere to voluntary payment plans agreed on at Complaints hearings contrary to the required professional and ethical conduct of the SEC Compliance Manual for Broker-Dealers, Investment Advisers and Representatives and general best international industry practice.

It said it also failed to submit statutory reports contrary to regulations, failed to pay penalties levied by the Commission and advertising of an unapproved investment product, Cardinal Master Trust in contravention of Securities Industry Act, 2016 (929) and Securities and Exchange Commission Regulations, 2003 (LI 1728).

Below is a copy of the statement from Group Nduom reacting to the revocation of the license of Blackshield

This evening, the Securities and Exchange Commission (SEC) posted a Notice of revocation of the licenses of various Fund Management Companies, including Blackshield Capital Management (Formerly Gold Coast Fund Management).

Groupe Nduom Limited, the entity representing the interests of the majority shareholders and founders of Blackshield, would like to note the following:

1.1. We are disappointed that SEC would take this action without responding to the numerous requests to,

a) assist Blackshield in retrieving funds owed by various Government of Ghana entities;

and b) review our plans to migrate customers into a private sector solution to Blackshield’s liquidity problem.

1.2. SEC’s Notice No. SEC/PN/012/11/2019 regrettably includes a number of misleading and/or untrue statements, including the assertion that 99.41% of Blackshield’s funds were placed in one investment vehicle.

1.3. We will continue to pursue legal action to collect funds owed in settlement of Blackshield client liabilities.

1.4. In the meantime, we ask all stakeholders to remain calm as we all wait for more details from SEC on the way forward.

Sincerely yours,

Papa Kwesi Nduom

Chairman and CEO Groupe Nduom

Source: Graphic.com.g