SEC’s ‘high-return investments carry high risks’ argument rubbished

Caution by the Securities and Exchanges Commission (SEC) to investors about high return investments has been described as unsound by the head of an institution that champions private sector development.

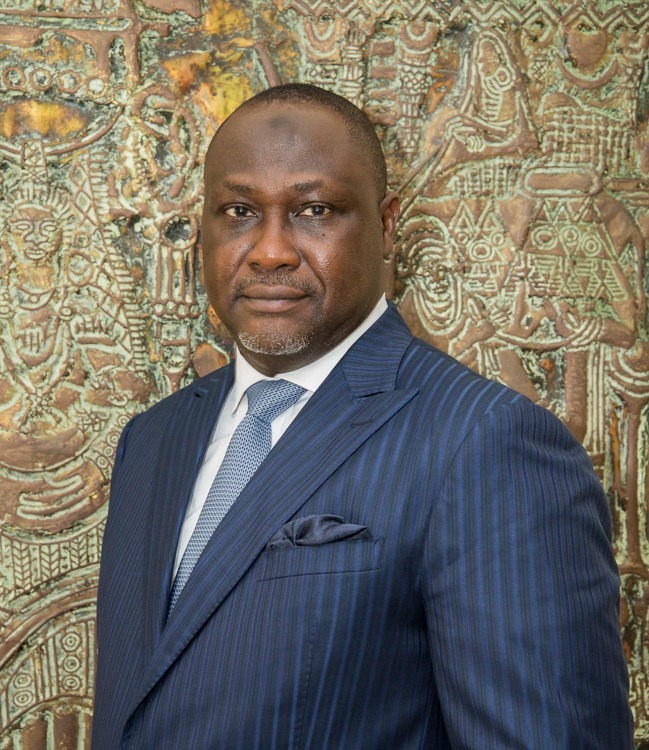

Chief Executive Officer of the Private Enterprise Federation (PEF), Nana Osei Bonsu II, has said on the Business Edition of PM Express on Thursday that caution from SEC suggests admittance that the regulator has failed in its risk assessment mandate of investment portfolios.

Following the challenges in the capital market, the SEC sought to warn the public against equating investments with depositing money in a bank.

Director General of SEC, Daniel Ogbarmey Tetteh, said last month that very often people forget the risks associated with investment – confusing it with merely depositing their money in a bank.

“One thing that people must know is that when you talk about investment, you are taking some risk. Every investment carries a degree of risk. If there is a risk, it means that there is also the possibility that you will lose part of your money or investment,” he said.

Bad counsel

However, Nana Osei Bonsu II said not only has the SEC’s caution come a bit too late but it also an admittance of dereliction of its legal mandate.

According to the PEF CEO, whatever risk assessments relevant to the credibility of the capital market should be the exclusive preserve of the SEC.

“Look at those people there (referring to a group of agitators whose monies been locked up with fund managers). Do you expect them to be able to assess risks? The risk assessment, to them, was done by the SEC before they [SEC] licenced these institutions,” he said.

According to him, warning investors against investing in high-return investments is suggesting that Ghana should not have any institutional regulators.

“So that to me is not a tenable argument,” he reiterated is disagreement about the SEC caution.

Refund

He also wants the government to assist with refunding locked up investments that were occasioned by the meltdown in the capital market.

He argues, “Government has a responsibility to make sure that its agencies and institutions perform in accordance with the law that established them.”

He insists that for the sake of confidence in the capital market, the government must step in swiftly to refund locked up cash like the assistance given to the banking sector.

“Let’s not forget, this is not the end of Ghana. There is tomorrow, and tomorrow and tomorrow. How are you going to attract people [in the future]?” he asked.

Meltdown

A top tier investment firm, Gold Coast Fund Management, along with other fund managers, has been in the news for their inability to pay clients’ invested capital and the interest accruing on same.

The Commission recently revoked the operating licences of Georgetown Capital Partners Ltd, Equity Capital Ltd, Index Analytics Ltd, DM Capital Ltd and Oxygen Advisory Ltd as part of a drive to clean up the investment sector.

Official records show at least GHS200 million have been locked up in Menzgold, an investment firm now dismissed as a Ponzi scheme.

Source: Myjoyonline.com