Royal Ghana Gold Refinery Saga: Is Agyapa back? – IMANI shares findings on Rosy Royal

IMANI Africa, a policy and education think tank, has raised serious concerns over the recently commissioned Royal Ghana Gold Refinery, which has been touted to be a game-changer in Ghana’s exploratory sector.

Vice President Dr. Mahamudu Bawumia commissioned the Royal Ghana Gold Refinery on August 8, 2024.

At the commissioning in Accra, Dr. Bawumia, the Flagbearer of the ruling New Patriotic Party (NPP), said that the establishment of a refinery in Ghana is a strategic investment which contributes immensely to the government’s efforts in ensuring value addition of Ghana’s mineral resources.

“The Vice President said that the government of President Nana Addo Dankwa Akufo-Addo has been determined to make value addition a critical component of the country’s export strategy since 2017 and the launch of the refinery is particularly important as it realises a key part of this vision.

“Originally, this vision was to be actualised through a joint venture between the Precious Minerals Marketing Company (PMMC) and Rosy Royal Minerals Limited. PMMC granted part of its land for the construction of the refinery and despite delays due to COVID-19, the beautiful edifice you see today, which started in 2018, was completed in 2022,” he said.

IMANI Africa has now dug up some of the supposed sketchy details on the establishment of Royal Ghana Gold Refinery.

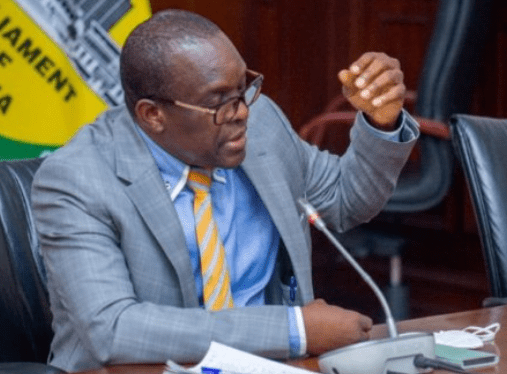

In a post shared on X on Tuesday, August 13, 2024, the Founder and President of IMANI Africa, Franklin Cudjoe, said that the actual cost of the refinery is $7 million and not $20 million, as being claimed.

He also refuted the assertion that the refinery was the first in Ghana, as asserted by proponents of the government.

“The current phase of the Royal Ghana Gold Refinery costs less than $7.5 million, according to insider sources. The $20-$25 million bandied about reflects planned future investments in subsequent phases.

“The intense international PR was to lead everyone in Ghana to believe that the refinery was built by and is majority owned by an obscure Indian company called ‘Rosy Royal’. It also aimed to erase from the public mind the existence of bigger, more sophisticated, and currently IDLE, gold refineries in the country. Ghana has almost a dozen gold refineries, by the way. Most of them are financially hamstrung due to a weak policy environment for local value addition,” he wrote.

Franklin Cudjoe also stated that the company the government stated was the majority owner of the refinery, Rosy Royal, knew nothing about gold refinery and was into quarry.

He added that its investigations into the books showed that it was in no financial position to afford the over $20 million said to be used to establish the refinery.

“And here is the banger: the real owners of the 80% equity stake in the refinery cannot be the company the government has announced: ‘Rosy Royal.’ We have examined its books over the last 6 years, and it never made any $20m+ investment to build a refinery anywhere. In fact, it runs a quarry and knows nothing about refining gold. Rosy Royal has no personnel at the refinery, which is actually chaired by a politician best known as an Eastern Regional Chairman of the ruling party and managed by an independent consultant, the founder of New Delhi’s Rare Tech. Unsurprisingly, the total capital of Royal Ghana Gold Limited in Ghana itself is just a little over $76,000.

“The “real 80% owners” of the new refinery have put everything skilfully together to secure a permanent stream of cash flows from Ghana’s gold. And they are on course to achieve that with zero effective upfront investment (given that the Bank of Ghana will end up covering even their initial investments when it pumps in working capital),” he added.

Read his full post below:

Is Agyapa Back? IMANI Preliminary Ask

*Update on the Royal Ghana Gold Refinery Saga*

1. The current phase of the Royal Ghana Gold Refinery costs less than $7.5 million, according to insider sources. The $20 – $25 million bandied about reflects planned future investments in subsequent phases.

2. The intense international PR was to lead everyone in Ghana to believe that the refinery was built by and is majority owned by an obscure Indian company called “Rosy Royal”. It also aimed to erase from the public mind the existence of bigger, more sophisticated, and currently IDLE, gold refineries in the country. Ghana has almost a dozen gold refineries, by the way. Most of them are financially hamstrung due to a weak policy environment for local value addition.

3. On the quiet, the Bank of Ghana (the central bank) has been primed to become the equity partner in the new gold refinery and is being asked to invest additional resources for various “enhancements” and trading capital. The Ghanaian state’s equity will thus move from PMMC (the national jeweller) to Bank of Ghana, and the “sleeping partners”, whoever they are, will be able to recoup all their upfront investments (due to the underlying cost inflation). Meaning that the *carried interest* of 20% held by the state is really a “ruse”. In a roundabout way, the Ghanaian state will end up paying for that refinery in full whilst owning just a 20% stake.

4. At the same time, the government is working hard to redirect assaying and refining business from existing refineries to the new refinery starting with the Bank of Ghana gold purchasing program. Those who think that policy is merely meant to boost Ghana’s reserves should now revise their notes. Reference is also made to our earlier essay on the Gold for Oil deal and the shadowy middlemen involved.

5. And here is the banger: the *real owners* of the 80% equity stake in the refinery cannot be the company the government has announced: “Rosy Royal”. We have examined its books over the last 6 years, and it never made any $20m+ investment to build a refinery anywhere. In fact, it runs a quarry and knows nothing about refining gold. Rosy Royal has no personnel at the refinery, which is actually chaired by a politician best known as an Eastern Regional Chairman of the ruling party and managed by an independent consultant, the founder of New Delhi’s Rare Tech. *Unsurprisingly, the total capital of Royal Ghana Gold Limited in Ghana itself is just a little over $76,000. *

6. The “real 80% owners” of the new refinery have put everything skilfully together to secure a permanent stream of cash flows from Ghana’s gold. And they are on course to achieve that with *zero effective upfront investment* (given that the Bank of Ghana will end up covering even their initial investments when it pumps in working capital).

Source: www.ghanaweb.com