Cedi stages shock comeback with 63% gain against dollar

Businesses and households can now breathe a deep sigh of relief, as the Ghana cedi has seen a shocking recovery against the US dollar as of mid-December – appreciating by 63.7 percent.

This comes as an unprecedented surprise, since just a few weeks ago the Ghana cedi was roughly battered by the US dollar in the foreign exchange market – suffering a year-to-date depreciation of 54.2 percent at the end of November, selling as low as GH¢15 to US$1.

But data from the Bank of Ghana indicates that as of December 15, 2022 the local currency wrestled the US dollar and appreciated by 63.7 percent in the process (now selling at around GH¢8), thereby trimming down the year-to-date depreciation to 24.9 percent.

This has eased the enormous and unbearable pressure on the price of goods that consumers experienced in the past two months, as prices at least doubled on the market due to exchange rate pressures. For example, diesel prices at the pumps in early November moved to more than GH¢23, but have now fallen to around GH¢16.

And for a country that is heavily dependent on imports, especially food products, the cedi’s stability has seen prices stabilise – albeit there have been no reductions.

The obvious question being asked is: what is/are accounting for this sudden recovery of the Ghana cedi, which was gasping for air in the intensive care unit with little hope of survival.

Basically, rapid depreciation in the exchange rate, according to the Bank of Ghana, was largely influenced by speculation – especially when it was apparent that government was going to embark on debt restructuring, leading to portfolio rebalancing in favour of foreign currency holdings as against Ghana cedi-denominated assets

To address this, the central bank introduced directives which sought to control this speculative behaviour.

It instructed banks and forex bureaus to only trade foreign currency to those who genuinely need it for transactions; demanding that such individuals or businesses provide proof of their need for foreign currency to conduct such business.

The Bank also embarked on an aggressive exercise to flush-out illegal forex operators, popularly known as ‘the black market’. As a result, together with the police it arrested more than 70 illegal forex operators in September – sending a strong message to the public that it is on the alert for such operators.

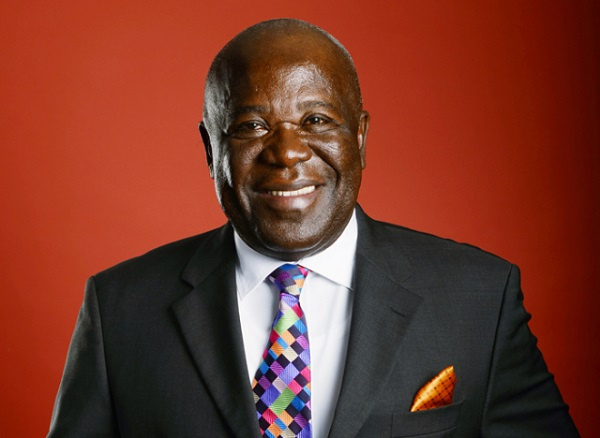

This, central bank Governor Dr. Ernest Addison said, became necessary due to the role being played by the black market in determining exchange rates on the forex market.

“Clearly, this type of movement does not reflect changes in the fundamentals. It’s clear that the market is not functioning properly. We are seeing speculation taking over under very disorderly market conditions, and it appears that now the black market is rather driving exchange rates. This we cannot allow to continue,” he said when meeting the Association of Forex Bureau Operators toward the end of October.

Dr. Addison further stated that the central bank is bent on restoring order in the forex market by making sure the interbank market takes full control to enforce regulations surrounding forex trading, so as to streamline the supply of foreign currency in the country.

As to whether the cedi’s recovery will be long-lasting or not, it is a matter that can only be determined by time. But in the meantime, the cedi’s outstanding performance – whether serendipitous or by deliberate policies – elicits a deep sigh of relief from businesses and households.