E-levy revenue will lead to jobs for over 11 million people – Ofori-Atta

11 million jobs can be created if the E-levy is implemented

The levy has proven divisive among MPs and unpopular to most Ghanaians

Government has hinted that it would step down the current 1.75% rate

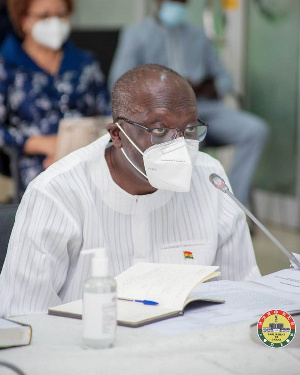

Finance Minister Ken Ofori-Atta has disclosed one of the main uses to which revenue from the electronic transactions levy (E-levy) will be put.

According to him, 11 million out of 18 million people without clear employment opportunities will be employed if the government gets the necessary revenue from the 1.75% levy.

The particular tax has generated lots of controversies after the Minority in Parliament purportedly voted to reject the 2022 budget with the E-levy being one of their core reasons.

Speaking at a Springboard Youth Roadshow at the University of Cape Coast over the weekend, Ofori-Atta noted that 58% of the population are between ages 15 to 59 which equates to some 18 million people.

He disclosed that 11 million of that number did not have clear employment opportunities adding that, “Of this number (18 million), 2.4million are in formal employment whilst the remaining 15 million are split between informal and underemployment.”

He explained further: “for us as a government, our task is to ensure we extend opportunities to the youth. The consequences of having eleven million people with no clear path, undoubtedly, our recovery efforts hinges on tailored support to provide skills and funding to our young people to pursue their ambition.”

“How do we as a nation move into an entrepreneurial stage to have an opportunity to contribute to national development? How do we reduce our debt and create employment?

“How do we take care of our infrastructure and roads so that we open up the country and build good Internet systems to create opportunities for all? Why are we being resistant to the future? We have nothing to fear. Have we as a nation understood the times that we are in and are we ready to sacrifice to move to a whole different level?”

To further buttress his point, the Minister challenged opponents to proffer a better route to cater for the 11 million people the government is seeking to employ with E-levy proceeds.

“When somebody tells you we shouldn’t go there, tell them, give me an alternative for these 11 million people who are at home and not working,” he added.

The Roadshow was held on the theme: “Building a Sustainable Entrepreneurial Nation; Opportunities for Ghana’s Youth”.

Meanwhile, talks are still ongoing on the levy with Deputy Majority Leader confirming that the government was ready to reduce the tariff to 1.5% from 1.75%.

The Minority leader whiles offering a personal position last weekend said he was convinced of the necessity of the tax and would accept a 1% rate to start with.

What Ofori-Atta said about 1.75% levy on electronic transactions

Ken Ofori-Atta introduced a new 1.75% levy on all electronic transactions such as Mobile money transactions, remittances and other electronic transactions.

Fees and charges of government services have also been increased by 15%.

The Finance Minister explained, “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.

“As such government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient.

“To safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day, which is approximately ¢3000 per month, will be exempt from this levy,” Ofori-Atta revealed.

Source: www.ghanaweb.com