What Dangote, Cardoso, Sanwo-Olu said as corporate Nigeria shuts down Lagos for Wigwe

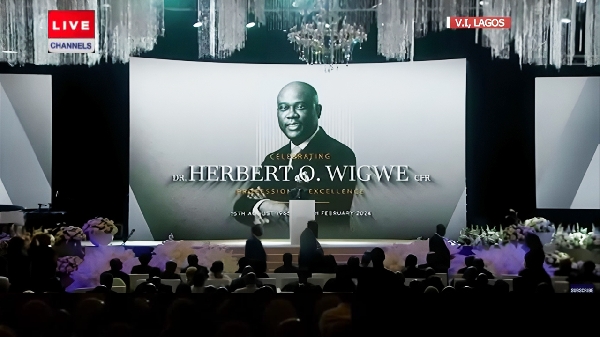

Corporate Nigeria and some political titans turned up yesterday to celebrate the life and times of the late Chief Executive Officer of Access Corporation Plc, Herbert Wigwe who all of them described as a titan.

In an emotion laden ‘Night of Tributes’ with touching memories, dignitaries from the public and private sectors, led by Africa’s richest man, Aliko Dangote, Minister of Finance, Wale Edun, governors of Lagos and Ogun states, Central Bank of Nigeria, CBN governor and bank chief executives sang praises of the late bank chief.

Wigwe, 57 years old, who was also MD/CEO Access Bank Plc, died in a helicopter crash in United States on February 9, 2024, alongside his wife, Chizoba Wigwe, his Son, Chizi Wigwe amd former President, Nigeria Exchange, Mr. Abimbola Ogunbanjo.

Other dignitaries at the event include President, African Development Bank, AfDB, Adesina Akinwunmi, Chairman Zenith Bank Plc, Jim Ovia, Chairman Coronation Capital, Mr. Aigboje Aig-Imoukhuede, CEO, GTHoldings Plc, Segun Agbaje, CEO of FirstBank Nigeria Limited, Adesola Adedutan and the President, Chartered Institute of Bankers of Nigeria, CIBN, Mr. Ken Okpara.

Dangote

In his tribute, Dangote descibed the late Herbert Wigwe as a loyal friend and a pillar of support for him and his family.

Fighting to hold back tears, Dangote narrated how late Herbert encouraged him in his business pursuits.

Dangote described the late Herbert as a visionary role model with courage second to none.

“I am proud to name him my devoted friend, mentee and supporter. I will forever cherish the warmth of his friendship,” Dangote said.

Dangote also disclosed plans to immotalise the late banker by naming the road to the Dangote Refinery as Herbert Wigwe road.

Adesina

AfDB President, Adesina Akinwunmi, in his tribute said: ‘’Herbert Wigwe brought pride to Nigeria and to Africa.

“He was relentless, determined, bold, visionary, inspiring, with exceptional drive for excellence. Everything he touched became gold

“Herbert is a bankers banker, and investors asset holder. His drive for major achievements sparks courage. Herbert was bankable and Access Bank was bankable.”

Aig-Imoukhuede

The chairman, Coronation Capital, Aigboje Aig-Imoukhuede, described Herbert Wigwe as a brilliant banker who help to transform the banking industry in Nigeria.

Edun

Minister of Finance, Wale Edun, described late Herbert as a pillar of support who was full of knowledge, ideas and creative thinking.

“He gave me his time and thinking. He had solutions, never at a loss,” said Edun.

Sanwo-Olu

Governor, Lagos State, Mr. Babajide Sanwo Olu, paid glowing tributes to the leadership qualities of late Herbert Wigwe, especially in rallying support to combat the COVID-19 pandemic.

“Herbert led from the front during the difficult period of COVID 19.

Describing the late banker as a brother, friend adviser, who supported the infrastructure drive of his administration, Sanwo Olu said Lagos would not forget Herbert Wigwe.

Gov Abiodun

Herbert believed in Nigeria—Dapo Abiodun

Ogun State governor on his part, praised the late Herbert for his commitment to Nigeria

“Herbert believed in Nigeria. He did everything to support Nigeria. He was intelligent, bold and lived two lifetimes in one.”

Cardoso

CBN Governor, Olayemi Cardoso described late Herbert Wigwe as a trully exceptional individual who played a pivotal role in transforming Access Bank into one of Nigeria’s foremost financial institutions.

I spoke with Herbert 2 weeks before he died —Agbaje

The Group Chief Executive Officer of GT Holdings, Mr Segun Agbaje, in his tribute, said he spoke with the late Herbert two weeks before he died, just as he described him (Herbert) as a fierce competiton.

Agbaje said: “It is indeed a very difficult for me. Herbert was my colleague, friend, competitor and brother. Only Herbert could have been all those things to a human being.

‘’We started as colleagues. I met Herbert in November 1991, we were both in the corporate bank. And then, as we all matured, Herbert became my real brother.

‘’He would alweays make the phone call to get you out of the spot you were in. It is weird that my last conversation with him was two weeks before he died.

He came to my house to talk about his obsession which was his university.”

Banks now borrow more from CBN to shore up cash position

Amidst sustained liquidity mop-up and monetary policy tightening by the Central Bank of Nigeria, CBN, there are indications that many deposit money banks are now resorting to heavy borrowing from the apex bank to meet up with their regulatory and other liquidity obligations.

CBN’s Financial Data for February 2024 obtained by Vanguard shows that the banks’ borrowing from the CBN Standing Lending Facility (SLF) increased month-on-month, MoM, by 65.5 percent to N5.96 trillion in February from N3.6 trillion in January 2024.

The data also shows that the banks deposited N330.71 billion in the CBN’s Standing Deposit Facility (SDF) in the same period, representing a 72.4 percent MoM, decline when compared with N1.2 trillion deposited in January 2024.

This development is coming at the backdrop of the various CBN policies to prepare banks against vulnerabilities from within and outside the country.

One of the latest policies is the increase in the benchmark interest rate, the Monetary Policy Rate, MPR, to 22.75 percent from 18.75 percent and Cash Reserve Ratio, CRR, to 45 percent from 32.5 percent last week.

Analysts are of the opinion that the increase in interest rate would raise asset yields of some banks by an average of 400 bases points (bps) in the financial year end of 2024.

In their Banking Sector update report for March, analysts at CardinalStone Research said: “Based on the first and second-order impacts of the rise in auction stop rates and 400 basis points increase in MPR to 22.75%, we now forecast asset yields to rise by an average of 400 bps across our coverage banks in FY’24 (vs c. 150 bps in our previous communication).

“This adjustment suggests a mean 83.4 percent increase in interest income for our banking coverage.

“Whilst the discontinuation of daily CRR debits is positive, the recent decision of the MPC to raise statutory CRR to 45 percent may appear a downside risk to interest income, with direct inference suggesting that banks can now only deploy 55 percent of new deposits to interest-earning opportunities assuming other rules (such as the loan to deposit ratio) are adhered to.

“We are of the view that the surging interest rate environment may increase pressure on banks to step up on the dividend front in the coming months. This may open avenues for decent dividend income (vs de-annualized return from fixed income options) in the near term.

“In our view, adverse macroeconomic conditions are likely to increase the risk of Non performing Loans , NPLs, in FY’24 (mean of 3.7 percent across our coverage), with sectors that are heavily reliant on imported raw materials and equipment maintenances such as manufacturing likely to be badly hit by the short-term cost implications of ongoing reforms.”

Source: www.vanguardngr.com