They reduced the debt value of GN Bank deliberately to collapse it – Dr Nduom

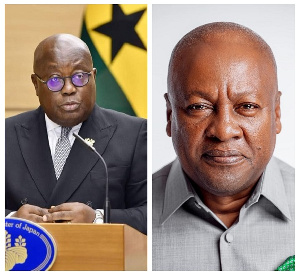

The Global Chairman of Groupe Nduom, Dr Papa Kwesi Nduom, has accused the Central Bank of Ghana of deliberately misrepresenting the debt value of his defunct GN Bank to ensure its closure.

Dr Nduom revealed that a debt of 2.2 billion Ghana cedis was reduced and recorded as 30 million Ghana cedis to make a case that the bank was unstable and facing a systemic risk.

The Group Chairman made these revelations while inspecting a former office of GN Bank at Roman Hill in Kumasi.

He also emphasized that his bank was wrongly shut down.

“People who said we only have about 30 million cedis, I know they did it deliberately because the same people, a year before, said they counted 640 million Ghana cedis.

“Meanwhile, they have seen a report by an independent auditor, which confirmed that the value of our project was 2.2 billion Ghana cedis. And so why did they use this to collapse the GN bank?” Dr Nduom asked, according to a report by myjoyonline.com.

Despite the bank’s allegation and legal actions challenging the decision of the Bank of Ghana (BoG) for revoking its banking license, an Accra High Court upheld the move by the BoG.

According to the court, the BoG breached no law.

Meanwhile, Dr. Nduom says shareholders and stakeholders of GN Bank will not relent but pursue justice.

“People were happy saving with us and the business was thriving. We are just sending a message because we have done things closed door and are not getting the results.

“We have to do this before Akufo-Addo leaves office and we want any government that may take over to know that, there is an outstanding matter to be resolved,” he said.

Source: www.ghanaweb.com