T-Bills: Government misses out on ambitious target by GH¢1.04 billion

The government of Ghana secured GH¢5.180 billion in its latest auction falling short of its target of GH¢6.228 billion by GH¢1.04 billion.

The auction on November 15, 2024, saw a high demand for the 91-day bills, securing bids amounting to GH¢3.942 billion.

The 182-day and 364-day bills secured bids worth GH¢653.43 million and GH¢584.16 million, respectively.

Interest rates for the 91-day bills stand at 26.96%, while interest rates for the 182-day and 364-day bills are at 27.78% and 29.21% respectively.

This will be the first time in five weeks that the government has recorded an undersubscription.

The government plans to raise GH¢6.896 billion in its latest auction.

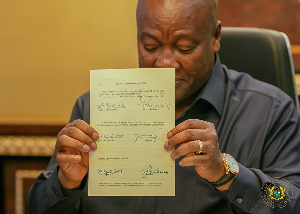

Last week, a Private legal practitioner, Jonathan Amable, has filed an application at the Supreme Court seeking to immediately halt the government’s issuance of treasury bills.

According to the writ, which was sighted by GhanaWeb, the plaintiff argues that the government can only borrow or issue treasury bills if it secures prior approval from Parliament.

The application was filed at the Supreme Court Registry on November 11, 2024.

Jonathan Amable contends that the government’s actions are contrary to the provisions in the 1992 Constitution and warns that the continued issuance of treasury bills without parliamentary approval will have severe consequences for the economy.

The defendant in the case is the Attorney General of the Republic of Ghana.

The lawsuit implies that if the government goes ahead to issue treasury bills, it would be deemed unconstitutional.

Source: www.ghanaweb.com