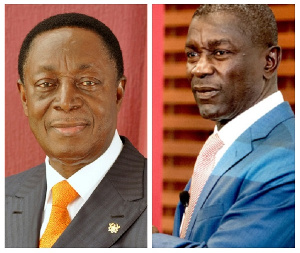

Parliament is the wrong forum for you – BoG to Duffuor, Amoabeng

The Bank of Ghana (BoG) has said the decision of Founders of the defunct banks, Unibank and UT, Dr Kwabena Duffuor and Prince Kofi Amoabeng respectively, to resort to parliament over the collapse of their banks was wrong.

The Central Bank says Parliament is not one of the mechanisms available to aggrieved persons within the laws to use for such purposes.

Therefore, the regulator said it cannot honour the invitation extended to it by Parliament after the two personalities petitioned the lawmaking body to probe the circumstances that resulted in the collapse of their banks.

“The BSDTI Act provides how persons who are aggrieved with such decisions may seek redress for their grievances, and the prescribed resolution mechanisms do not include recourse to Parliament,” the BoG said through its lawyers, Bentsi-Enchill Letsa and Ankomah.

In their petition, Dr Duffuor and Mr Amoabeng are asking the Committee to “Investigate the conduct of the Bank of Ghana and the Ghana Stock Exchange for the revocation of UT Bank’s licence and delisting the bank without due regard to the rules of Administrative Justice guaranteed under Article 23 of the 1992 Constitution.

“Direct the restoration of the banking license of UT Bank Limited by the Bank of Ghana and the remedying of the harms done the shareholders’ property rights as a result of the conduct of the Bank of Ghana.”

They also said “Investigate the conduct of the Bank of Ghana in the takeover, appointment of an Official Administrator of uniBank Ghana Limited and the circumstances surrounding the revocation of the banking license of uniBank Ghana Limited.”

“Direct the restoration of the banking license of uniBank Ghana Limited by the Bank of Ghana and the remedying of the harms done the shareholders’ property rights as a result of the conduct of the Bank of Ghana.”

The Bank of Ghana (BoG) in August 2018 announced that it has revoked the licenses of five banks and put them together as Consolidated Bank Ghana Limited. The banks were uniBank Ghana Limited, The Royal Bank Limited, Beige Bank Limited, Sovereign Bank Limited, and Construction Bank Limited and appointed Nii Amanor Dodoo of KPMG as the Receiver for the five banks.

Prior to the amalgamation of the five banks, the Central Bank had closed down UT Bank and Capital Bank in August 2017.

uniBank, according to the BoG, was identified during the Asset Quality Review update in 2016 exercise to be significantly undercapitalised and beyond rehabilitation.

“Shareholders, related and connected parties had taken amounts totaling GH¢3.7 billion which were neither granted through the normal credit delivery process nor reported as part of the bank’s loan portfolio.

“In addition, amounts totaling GH¢1.6 billion had been granted to shareholders, related and connected parties in the form of loans and advances without due process and in breach of relevant provisions of Act 930.”

“Altogether, shareholders, related and connected parties of uniBank had taken out an amount of GH¢5.3 billion from the bank, constituting 75 percent of total assets of the bank,” the Central Bank explained back in 2018.

On UT Bank, the Central Bank stated in a press release: “This action has become necessary due to severe impairment of their capital.”

Source: 3news.com