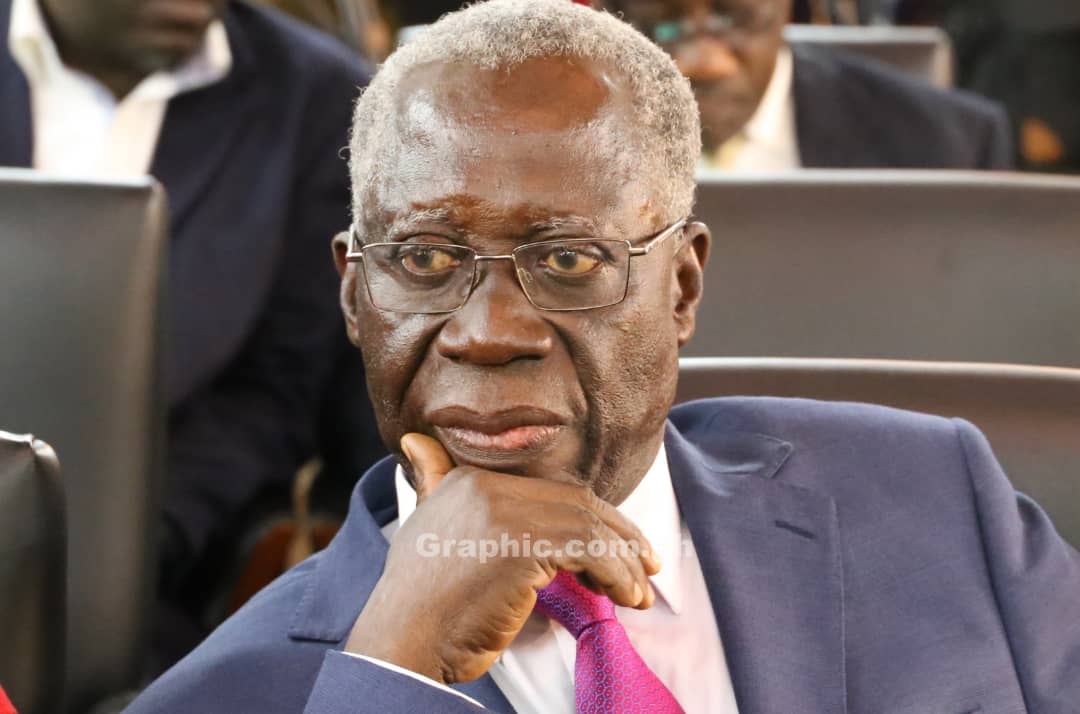

Osafo Marfo alerts NIC imminent collapse of insurance companies

Senior Minister Hon Yaw Osafo-Maafo has strongly cautioned authorities of National Insurance Commission to tighten their supervision over existing insurance brokers in the country.

The collapse and consolidation of several commercial Banks in Ghana according to him is likely to replicate within the insurance sector if National Insurance Commission sleeps on its regulatory supervision.

He challenged that NIC shouldn’t sit aloof and watch the repetition of issues such as non-existing capital and bad Banking practices which were uncovered in the Banking industry hence the collapse of a number of financial institutions.

“…what happened in the Banking sector is not an event too far from your business. It is due to regulatory failure coupled with poor corporate governance structures as well as poor banking practices” he made this indication when he was addressing insurance brokers at the GIBA 6th Annual Conference and Exhibition in Kumasi.

Hon Osafo-Maafo announced government’s dissatisfaction over the 2% GDP contribution made by Insurance industry.

In other to ensure effective delivery, he advised insurance brokers to consider changing their business models of establishing so many smaller local insurance and broking firms and begin to consider mergers and build strong local firms that are able to carry more risk and compete efficiently with some of the multinational companies entering the Ghanaian market.

NIC he advised should also put into consideration the categorization of insurance companies into tiers depending on the size and capitalisation as done in other jurisdiction.

“I am told Nigeria National Insurance Commission is preparing to categorise insurance brokers into corporate broker and partnership broker with licensing fees of N5 million and N3 million respectively.

…we need to learn from the best practices around us. South Africa which generates about 70% of Africa’s $50 billion premiums has less than 20 insurance companies operating in their market. We have almost 60 companies sharing less than $600million life and non-life premiums.

…Unless we continue to make conscious effort to grow the capital of our business, we will continue to under-perform which will not be good for our country” he told NIC and insurance brokers during the conference.

Source: Thepressradio.com Enock Akonnor