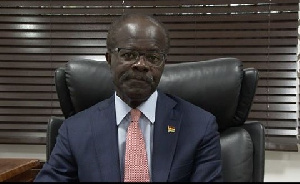

Ofori-Atta justifies new taxes by Gov’t

Finance Minister-designate, Ken Ofori-Atta has justified the 1 percent COVID-19 levy introduced in the 2021 budget statement following the agitation over the new tax.

Ofori-Atta believes this will among other things prop-up the health system against the pandemic and also support the payment of COVID-19 vaccines imported into the country.

“It is important that we have the 1 percent COVID-19 levy on VAT which essentially is looking at making sure that we are able to pay for the vaccines and get our people working, and so we don’t have lockdowns and also undertake other projects such as Agenda 111 so that our infrastructure for healthcare will be a lot more robust,” Mr. Ofori-Atta made this known in a virtual post-budget forum by PricewaterhouseCoopers.

There has been a hue and cry over the announcement of the introduction of a COVID-19 levy among others.

Caretaker Minister for Finance, Osei Kyei-Mensah-Bonsu announced the taxes in Parliament last Friday when he presented the 2021 budget.

“To provide the requisite resources to address these challenges and fund these activities, the government is proposing the introduction of a COVID-19 Health Levy of a one percentage point increase in the National Health Insurance Levy and a one percentage point increase in the VAT Flat Rate to support expenditures related to COVID-19,” Mr. Kyei-Mensah-Bonsu disclosed.

The newly proposed levy yet-to-be-approved will be a one percentage point increase on both the existing VAT Flat Rate Scheme (VFRS) and National Health Insurance Levy (NHIL).

Source: Ghana/Kasapafmonline.com