Nigerian billionaire buys Panama Canal Ports for $23 billion after acquiring UK airport

Hong Kong-based conglomerate has agreed to sell its shares in a subsidiary operating near the Panama Canal to a consortium, including Global Infrastructure Partners, a subsidiary of BlackRock Inc.

According to reports, US President Donald Trump alleged Chinese interference with the shipping line operations.

Nigerian billionaire, Adebayo Ogunlesi’s firm, Global Infrastructure Partners, will operate the deal via collaboration with TIL.

In a filing, CK Hutchison Holdings disclosed that it would sell all shares in the Hutchison Port Holdings and Hutchison Port Group Holdings to the Consortium in a deal estimated at almost $23 billion, including $5 billion in debt.

The deal will give the BlackRock consortium control over 43 ports in 23 countries, including Balboa and Cristobal in Panama and others in Mexico, the Netherlands, Egypt, Australia, Pakistan, and elsewhere.

About 70% of the sea traffic crossing the Panama Canal leaves or goes to the US ports.

The New Telegraph reports that the US built the canal in the early 1900s as it looked for means to facilitate the transit of commercial and military vessels between its coasts.

The US government gave up control of the waterway to Panama on December 31, 1999, under an agreement signed in 1977 by President Jimmy Carter.

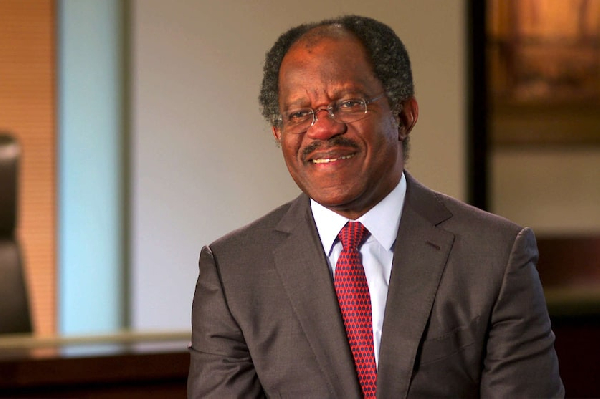

Adebayo Ogulesi has solidified his position as one of the world’s wealthiest persons, with a net worth of $1.7 billion on the Forbes billionaire list.

The achievement secures Ogulesi’s spot as Nigeria’s fifth billionaire and boosts Africa’s growing list of high-net-worth persons.

Forbes’ newest valuation confirms a shift eight months after Bloomberg reported his rise among African billionaires.

According to reports, Bloomberg estimated Ogunlesi’s net worth at $2.3 billion following a $12 billion deal with BlackRock Inc., the world’s largest asset management company.

The 72-year-old Nigerian is the Chairman, CEO, and co-founder of Global Infrastructure Partners (GIP), a New York-based infrastructure investment company.

His current ranking places him among the world’s top 2,000 wealthiest persons, at 1,945 globally.

The rise in his wealth is closely tied to GIP’s billion-dollar deal with BlackRock, which was finalised in January this year.

The partnership, valued at $12,5 billion, will establish a leading multi-asset class infrastructure investment company.

The deal included a $3 billion cash component and the issuance of about 12 million shares of BlackRock common stock, collectively valued at $9.5 billion.

It brings together a combined clientele under Management (AUM) exceeding $150 billion.

Ogunlesi’s extensive career includes a tenure as Lead Director at Goldman Sachs Group, Inc., and board positions at many high-profile firms such as Callaway Golf Company, Kosmos Energy Holdings, Terminal Investment Limited, and Freeport LNG.

He spent two decades at Credit Suisse before founding GIP, expanding the firm’s portfolio beyond traditional finance into sectors such as transportation, natural resources, and power generation.

The company has evolved into the world’s largest independent infrastructure manager, overseeing over $100 billion in assets, with infrastructure equity funds accounting for the firm’s $60 billion portfolio.

Ogunlesi and GIP’s founders will continue to pilot the new platform, leveraging their expertise in investment and operational enhancements.

Source: legit.ng