Mobile apps for managing European investments from Africa

For African investors eyeing the lucrative European markets, mobile apps have become indispensable tools. They offer unprecedented access to global exchanges, enabling real-time trading, portfolio monitoring, and financial insights from the convenience of a smartphone. While the opportunities are vast, selecting the right app and understanding the underlying processes is crucial for a seamless and secure investment journey from Lagos, Accra, or anywhere across the continent.

This article delves into the various types of mobile apps available for managing European investments from Africa, highlighting their features, key considerations, and essential advice for African investors.

The Rise of Mobile Investing in Africa

The proliferation of smartphones and improved internet connectivity across Africa has democratised access to financial markets. Many traditional barriers to international investing – such as high minimums, complex paperwork, and limited access to information – have been significantly reduced by mobile technology. For Africans, these apps represent a powerful gateway to diversify wealth, hedge against local currency fluctuations, and participate in the growth of established European economies.

Types of Mobile Apps for European Investments

Broadly, mobile apps for European investments can be categorised based on their primary function:

-

Direct Trading & Brokerage Apps: These are the most common and directly allow users to buy, sell, and manage various financial instruments listed on European exchanges or derivative markets tied to them.

- Features:

- Access to European Stocks & ETFs: Buy shares of companies like SAP, LVMH, Siemens, or ETFs tracking major European indices (DAX 40, Euro Stoxx 50, FTSE 100).

- Forex Trading: Trade currency pairs involving the Euro (e.g., EUR/USD, EUR/GBP).

- CFDs (Contracts for Difference): Speculate on price movements of European stocks, indices, commodities, and even cryptocurrencies without owning the underlying asset. Many popular brokers for African users, like AvaTrade, FP Markets, XM, Deriv, and Vantage Markets, offer robust CFD trading via their mobile apps.

- Real-time Data & Charts: Access live quotes, interactive charts, and technical analysis tools.

- Order Types: Place market orders, limit orders, stop-loss orders, and take-profit orders.

- Watchlists & Alerts: Customise watchlists to monitor specific European assets and set price alerts.

- Account Management: Fund and withdraw money, view transaction history, and manage account settings.

- Examples of Global Brokers with Strong Mobile Apps (Accessible from Africa):

- Interactive Brokers: Known for its wide range of products, low fees, and advanced trading tools. Their mobile app, IBKR Mobile, offers comprehensive functionality.

- XTB: Provides a great selection of CFDs on European stocks, ETFs, forex, commodities, and indices.

- AvaTrade: Offers an intuitive mobile app, AvaTradeGO, with unique features like AvaProtect™ for risk management and social trends.

- FP Markets: Features MT4/MT5 mobile apps, allowing access to forex, shares, indices, and commodities.

- Deriv: Popular in Africa for its user-friendly interface and access to forex, stocks, indices, and synthetic indices.

- Vantage Markets: Offers trading on EU shares via CFDs with competitive spreads and a user-friendly app.

- Webull: (While primarily US-focused, it’s gaining traction in SA and might expand to other African markets for global access, offering commission-free trading on stocks/ETFs).

- Features:

-

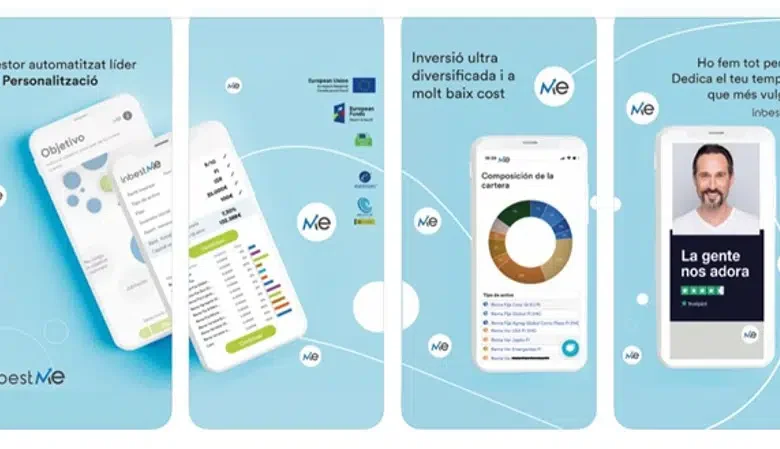

Wealth Management & Robo-Advisor Apps: These apps are designed for long-term investors who prefer automated portfolio management or a more guided approach. While some might focus on local markets, a growing number offer international exposure.

- Features:

- Automated Investing: Robo-advisors build and manage diversified portfolios based on your risk tolerance and financial goals, often including European ETFs.

- Goal-Based Investing: Set specific financial goals (e.g., retirement, buying property) and track progress.

- Low Fees: Often have lower management fees than traditional financial advisors.

- Easy Setup: Streamlined onboarding process.

- Examples:

- While direct European robo-advisors might have residency restrictions, some global wealth platforms that partner with local institutions might offer this. FNZ is an example of an end-to-end wealth management platform provider that partners with financial institutions globally, which could indirectly lead to app-based investment solutions for Africans through their local banks or wealth managers.

- Local African apps like EasyEquities (South Africa) allow investing in fractional shares of US and European companies through their platforms, making international investing accessible even with small amounts. Their “EasyFX” solution helps fund international wallets.

- Features:

-

Financial News & Analysis Apps: These apps provide crucial market information but do not facilitate trading directly. They are essential companions for any investor.

- Features:

- Real-time News: Breaking news from European markets and global finance.

- Economic Calendar: Track key economic data releases that can impact European markets.

- Market Analysis: Insights from experts, technical analysis tools, and charting capabilities.

- Portfolio Tracking: Monitor your investments across different brokers (by manually inputting data).

- Examples:

- Investing.com: Comprehensive financial news, data, and tools for global markets, including Europe.

- Bloomberg, Reuters, Financial Times: Reputable sources for in-depth financial news and analysis.

- Features:

Key Considerations for African Investors

When selecting and using mobile apps for European investments, African investors should pay close attention to:

- Regulation and Licensing: This is paramount. Ensure the brokerage firm or platform is regulated by reputable financial authorities in its operating jurisdiction (e.g., FCA in the UK, CySEC in Cyprus, BaFin in Germany). For your protection, avoid unregulated platforms.

- Acceptance of African Clients: Not all international brokers or apps accept clients from all African countries due to regulatory or compliance reasons. Always verify this before starting the sign-up process.

- Funding and Withdrawal Methods: Check the available deposit and withdrawal options. Look for methods that are convenient and cost-effective for you, such as bank transfers, debit/credit cards, and e-wallets. Understand any associated fees for currency conversion (e.g., Naira/Cedi to Euro/USD) and international transfers.

- Fees and Commissions: Compare trading fees, spreads, inactivity fees, withdrawal fees, and currency conversion charges. These can significantly impact your overall returns, especially for frequent traders.

- Minimum Deposit Requirements: Some platforms have minimum deposit amounts, which can vary.

- Customer Support: Access to responsive and helpful customer support is vital, especially when dealing with cross-border transactions and potential technical issues.

- User Interface and Experience: The app should be intuitive, easy to navigate, and stable. A cluttered or glitchy app can hinder effective trading and management.

- Security Features: Ensure the app uses robust security measures, including two-factor authentication (2FA), encryption, and segregated client accounts.

- Tax Implications: Understand your tax obligations in your home country (e.g., Nigeria, Ghana) and in the European country where the investment platform is based. Consult with a tax advisor specializing in international investments to navigate potential double taxation agreements (DTAs) and reporting requirements (like CRS/FATCA).

- Capital Controls (Nigeria/Ghana specific): Be aware of your country’s foreign exchange regulations and capital control limits on outward remittances. These regulations can impact how much you can deposit into your overseas investment account and how easily you can repatriate profits.

Essential Advice for African Investors

- Start Small: Especially if new to international investing or mobile trading, begin with a small amount you are comfortable losing.

- Educate Yourself: Utilise the educational resources provided by brokers (tutorials, webinars, demo accounts) to understand market dynamics and app functionalities.

- Practice with Demo Accounts: Before committing real money, use a demo account to familiarise yourself with the platform and test your strategies in a risk-free environment.

- Diversify: Don’t put all your eggs in one basket. Diversify across different assets, sectors, and even European countries.

- Stay Informed: Keep abreast of European economic news, geopolitical events, and global market trends, as these significantly impact investment performance.

- Seek Professional Advice: For complex investment strategies or significant capital, consider consulting a financial advisor with cross-border expertise.

Mobile apps have undeniably revolutionised access to European investment opportunities for African investors. By carefully selecting the right platforms, understanding the associated costs and regulations, and adopting a disciplined approach, Africans can effectively manage their European portfolios and partake in global wealth creation.

Source: Thepressradio.com