IMF deal: Government to collapse more banks

According to the lawmaker, certain conditionalities contained in Ghana’s recently approved IMF programme, will force the government to recapitalize some banks in Ghana.

Making his submission on Metro TV’s Good Morning Ghana show, the Bolgatanga Central MP said the IMF programme has made certain provisions for the recapitalization of banks operating in Ghana.

“When Consolidated Bank Ghana [CBG] was created to take over the assets of insolvent banks, they were not given any funds by government but were rather issued bonds to CBG as resolution bonds to cover the difference between the deposits, assets and liabilities…in other words another CBG is on the way because government does not own banks which it cannot capitalize”.

“It is envisaged in the IMF programme of the possibility that some banks will go down and government will need to intervene in a formula similar to that the 9 banks that were collapsed by the Central Bank during the clean-up exercise and later consolidated,” the MP added.

He further revealed that under Ghana’s IMF programme, an amount of GH¢19 billion has been earmarked as resolution bonds for banks which are expected to be used under the Fund’s programme for Ghana.

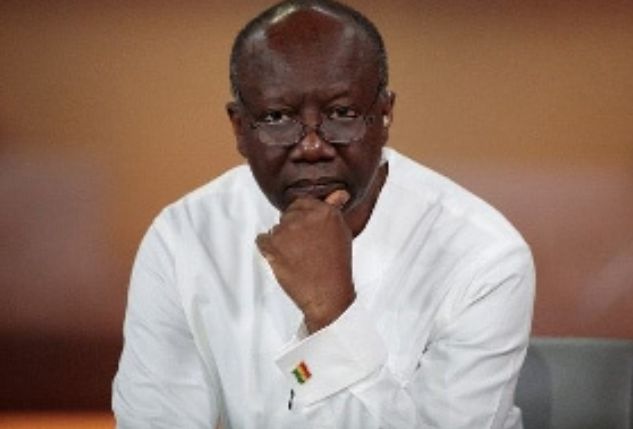

Meanwhile, Bank of Ghana Governor, Dr Ernest Addison, recently announced that commercial banks operating in the country have been given up to September this year to submit their recapitalization plans.

He noted that banks are expected to approach their shareholders before the recapitalisation exercise adding that should they encounter some difficulty in doing so, they may have to seek assistance from the yet-to-be operationalised Financial Sector Stability Fund.

“Right now, we have reduced the capital adequacy ratio to 10 percent and we are hoping that over the next three years, the banks will be able to rebuild their capital buffers and hopefully at that time we may bring in the additional three percent capital buffer,” the BoG Governor said during the 112th MPC press briefing in Accra.

He continued, “They [Banks] have been given a period of up to September to submit their plans and we will be following up on them to ensure that instead of distributing profits that they have started making, they will use those resources to rebuild their capital reserves.”

Source: www.ghanaweb.com