IMF backs removal of COVID-19 levy as new tax reforms receive high approval rate

The government’s move to remove the COVID-19 levy from the country’s tax laws has received a strong endorsement from the International Monetary Fund (IMF), following engagements with the government.

This gives the government the goodwill to proceed with the initiative, which is likely to feature in the mid-year budget review by the Finance Minister, Dr. Casel Ato Forson, on Thursday, July 24, 2025.

According to the Ghana Revenue Authority (GRA), several engagements on the new tax reforms have progressed steadily, as the local business community aligns with the IMF on some of the proposed initiatives.

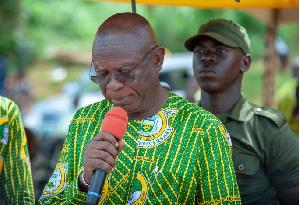

Speaking to Joy Business, Commissioner of the Domestic Tax Revenue Division at the GRA, Edward Apenteng Gyamera, disclosed that stakeholders agreed on the removal of the COVID-19 levy, as well as other tax components that hamper business growth.

The Commissioner was speaking at one of the stakeholder engagements on the proposed tax reforms in Accra, where many business associations expressed confidence that the reforms will ease the tax burden on businesses while supporting domestic revenue mobilization.

“I think from the engagements with stakeholders and the IMF, issues that the Minister even indicated in the budget — for instance, the removal of the COVID levy — is something that has been agreed upon. I think so far, with our interaction with the stakeholders, everybody is of the view that this levy should be taken off when the reform is completed.

“Then the removal of the cascading effect of the levies — treating the levies as part of the VAT mechanism, where businesses can claim input and deductions — has been generally accepted by all,” he added.

The COVID-19 levy was introduced by the previous government to raise funds in support of COVID-19-related activities, as the government sought to revive the economy.

The levy was passed under the COVID-19 Health Recovery Levy Act, 2021, and assented to by then President Nana Addo Dankwa Akufo-Addo. It imposed a special levy — the COVID-19 Health Recovery Levy — on the supply of goods and services and on imports, to raise revenue to support COVID-19 expenditures and related matters.

Source: Ebenezer Sabutey