How Central Banks Influence the Economy through Monetary Policy

Central banks play a critical role in shaping a country’s economy. Through the use of monetary policy, they influence everything from inflation and interest rates to employment and overall economic growth. Whether you’re a student, investor, entrepreneur, or simply curious about how economies function, understanding how central banks operate is key.

This article breaks down what monetary policy is, how central banks use it, and how it affects individuals and businesses in the real economy.

What Is Monetary Policy?

Monetary policy refers to the actions taken by a country’s central bank to control the money supply, inflation, interest rates, and credit availability in the economy.

The goal is to maintain price stability, promote economic growth, and support employment. In many countries, central banks also ensure the stability of the financial system.

Who Conducts Monetary Policy?

In most countries, a central bank is in charge of monetary policy. Examples include:

-

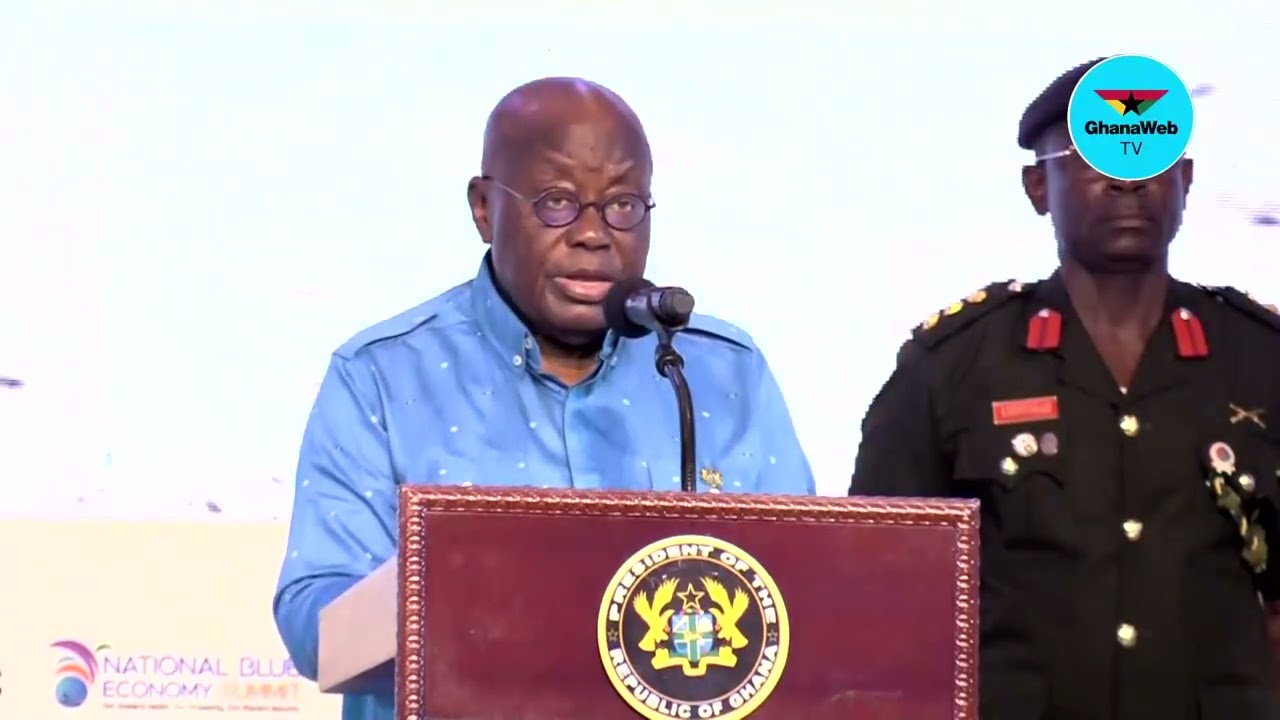

Bank of Ghana (Ghana)

-

Central Bank of Nigeria (Nigeria)

-

Federal Reserve (USA)

-

European Central Bank (EU)

-

Bank of England (UK)

These institutions are usually independent from political influence, allowing them to make long-term decisions focused on economic stability.

Tools Central Banks Use to Influence the Economy

Central banks use various tools to implement monetary policy. These tools are divided into two types:

1. Conventional Tools

a. Interest Rate Policy

-

The central bank sets the policy interest rate (e.g., Ghana’s Monetary Policy Rate or the U.S. Federal Funds Rate).

-

Lowering interest rates encourages borrowing and spending.

-

Raising interest rates reduces inflation by making borrowing more expensive and encouraging saving.

b. Open Market Operations (OMO)

-

The buying and selling of government securities (like bonds).

-

When the central bank buys bonds, it injects money into the banking system (expansionary).

-

When it sells bonds, it pulls money out (contractionary).

c. Reserve Requirements

-

The percentage of deposits banks must hold in reserve.

-

Lowering reserve requirements increases the money available for lending.

-

Raising them reduces the lending capacity of banks.

2. Unconventional Tools

These are used in extreme cases, such as economic crises:

-

Quantitative easing (QE): The central bank buys large-scale assets to inject liquidity.

-

Forward guidance: The central bank communicates future policy directions to influence market expectations.

Types of Monetary Policy

1. Expansionary Monetary Policy

Used when the economy is slowing down or in a recession.

Goals:

-

Increase money supply

-

Lower interest rates

-

Boost spending and investment

Impact:

-

Job creation

-

Economic recovery

-

Possible increase in inflation

2. Contractionary Monetary Policy

Used when inflation is too high.

Goals:

-

Reduce money supply

-

Raise interest rates

-

Slow down spending

Impact:

-

Controls inflation

-

May reduce economic growth in the short term

How Monetary Policy Affects You

1. Consumers

-

Interest rates affect the cost of borrowing (e.g., loans, mortgages).

-

Lower interest rates = cheaper credit = more spending.

-

Higher interest rates = higher loan costs = more saving.

2. Businesses

-

Affects business loans, investment decisions, and consumer demand.

-

When rates are low, companies are more likely to expand and hire.

3. Investors

-

Interest rates influence stock and bond markets.

-

Lower rates often lead to higher stock prices due to cheaper borrowing.

4. Exchange Rates

-

Monetary policy can impact currency strength.

-

Higher interest rates attract foreign investment, strengthening the currency.

-

Lower rates may weaken the currency, boosting exports.

Example: Bank of Ghana in Action

Suppose inflation in Ghana rises sharply. The Bank of Ghana might respond by:

-

Raising the policy rate

-

Making loans more expensive

-

Slowing consumer spending

-

Stabilizing prices

If the economy slows down, the Bank of Ghana could:

-

Lower the policy rate

-

Encourage investment and job creation

-

Stimulate growth

Final Thoughts

Monetary policy is one of the most powerful tools central banks use to steer the economy. Through interest rates, reserve requirements, and open market operations, central banks can boost growth or control inflation depending on the situation.

As a citizen, business owner, or policymaker, staying informed about monetary policy decisions can help you make smarter financial and economic choices.

Source: Thepressradio.com