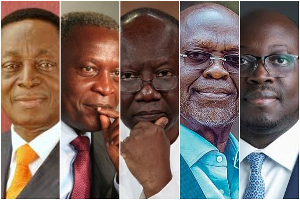

Here’s what Alban Bagbin told Ofori-Atta about E-Levy, other taxes

According to Alban Bagbin, E-Levy was not the best option to get the informal sector to pay taxes.

He, however, said the rate he [Bagbin] suggested was less than zero percent as most people that fall within this category were the finance minister’s target.

Making this known when he met with the management of Media General in Accra on Thursday, June 29, 2023, the Speaker of Parliament noted that the introduction of a lottery tax could be a way government can rake in more revenue for the state.

He explained that with the lottery tax, the customer uses tax receipt numbers to play the lotto.

“I made it known to the Finance Minister long ago that there are so many areas where we can raise revenue, not E-Levy. But if you wanted to use e-levy, let us start from zero point something percent and then go up. You have an informal economy where a large percentage of the people are outside the tax net. Because of no documentation, you will never know their income, there are things that you have to do to bring them to the formal sector. I suggested to him the lottery tax,” Alban Bagbin said.

He added that, “The lottery tax is very simple, you use tax receipt numbers to play the lotto and every week, one tax receipt number will win and you can give a pickup to the person. So everybody now comes in because the person wants to win a pickup and so they start issuing receipts.”

“And so they formalize the informal businesses. Countries have done it, Malaysia and the rest and they jumped over 500 percent increase in revenue. I discussed this with the Minister,” the Speaker of Parliament highlighted.

He further noted that insurance and narcotics were areas government can earn a lot of money.

The introduction of E-Levy, according to the government forms part of measures to help improve its domestic revenue mobilisation.

The E-Levy tax was reviewed downwards from 1.5% to 1% following several criticisms.

Data from the Ghana Revenue Authority (GRA) revealed that the Electronic Transfer Levy generated GH¢246.9million in revenue, accounting for 11 percent of the projected GH¢2.24billion for the year.

Since its implementation in May 2022, the E-Levy had generated a total of GH¢861.47million revenue by March 2023.

Source: www.ghanaweb.com