Help avert banking crisis – Akufo-Addo to PFSAC

President Akufo-Addo has requested of the newly inaugurated Financial Stability Advisory Council to assist government in ensuring that the banking sector does not return to crisis again.

Addressing members of the Council at the Jubilee House after administering the Official Oath and the Oath of Secrecy to them, Akufo-Addo said weakness in the banking system undermines confidence in the flow of funds in the country.

“We asked ourselves, why did it take so long to recognize these problems and to deal with them in order to safeguard the public interest. Was this a system’s failure, or these banks were simply clever in going about their businesses on the blind side of regulators?” he asked.

“A financial system in distress introduces uncertainty in the economy and undermines the stability and soundness of the financial system. It is to prevent any disastrous occurrence in the banking system and its ramifications in the entire financial system that my government has taken the bold step to establish the Presidential Financial Stability Advisory Council,” Akufo-Addo said.

Role of the Advisory Council

The role of the Presidential Financial Stability Advisory Council, according to the President, will be to advise the President, “on how to strengthen and reinforce the stability of the financial sector acting as an inter-institutional consultative coordinating body; coordinate regulation supervision at the micro level by focusing on matters of common concern for the various financial regulators involved in the regulations and supervision of financial entities in Ghana namely, the Bank of Ghana, Securities and Exchange Commission, National Insurance Commission, and the National Pensions Regulatory Authority and to evaluate and mitigate financial stability risk by focusing on the timely detection and mitigation of risk in the stability of Ghana’s financial system.”

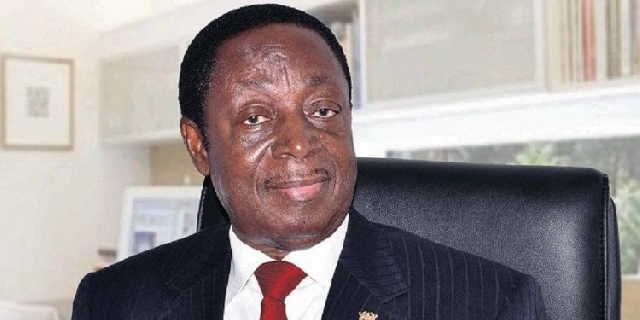

In his response, chairperson of the Council and current Governor of the Bank of Ghana, Dr. Ernest Addison said the establishment of the Council is a significant milestone in the country’s financial system.

“We know that there are weighty issues to be addressed and our mandate is so critical to safeguard the overall stability of our financial system. There is no doubt in my mind that with the rich and diverse backgrounds of Council members, we can instill discipline in the various financial sectors and entrench financial stability to support government’s transformational agenda,” Dr. Addison said.

Membership of the Council

Other members of the Council are Mrs. Elsie Addo, Deputy Governor of the Bank of Ghana; Mr. Charles Adu Boahen, Deputy Minister for Finance; Mr. Justice Yaw Ofori, Comm?ssioner, National Insurance Commission; Mr. Daniel Ogbarmey, Director-General of the Securities and Exchange Commission; Mr. Hanford Atta Krufi, Chief Executive Officer of the National Pensions Regulatory Authority and Mr. Ignatius Wilson Director of the International Growth Centre.

Source: Starrfm.com.gh