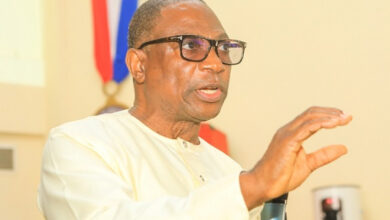

Ghana initiates comprehensive review of VAT regime – Ato Forson

This development was confirmed during a high-level meeting between Ghanaian officials and Wencai Zhang, Managing Director and Chief Administrative Officer of the World Bank Group.

During the engagement, Ghana’s Finance Minister, Dr Cassiel Ato Forson, outlined the country’s commitment to reforming the VAT system in close collaboration with international partners.

Dr. Forson noted that a Technical Assistance Mission from the International Monetary Fund (IMF) is currently in Ghana, working alongside local authorities to support the review process.

He acknowledged that the current effective VAT rate of 21.9%, one of the highest in Africa, has contributed to compliance difficulties and inefficiencies for businesses.

“We are fully aware of the challenges posed by the existing VAT structure. That is why we are undertaking a complete overhaul of the system. I can assure our partners and the Ghanaian public that this reform process will be concluded before the main budget is presented in November,” he said.

The initiative is seen as a crucial step in improving tax compliance, enhancing revenue mobilisation, and making the tax system more business-friendly.

The World Bank expressed support for Ghana’s reform efforts and reiterated its commitment to working closely with the government to achieve a more efficient and equitable tax regime.

Source: mofep.gov.gh