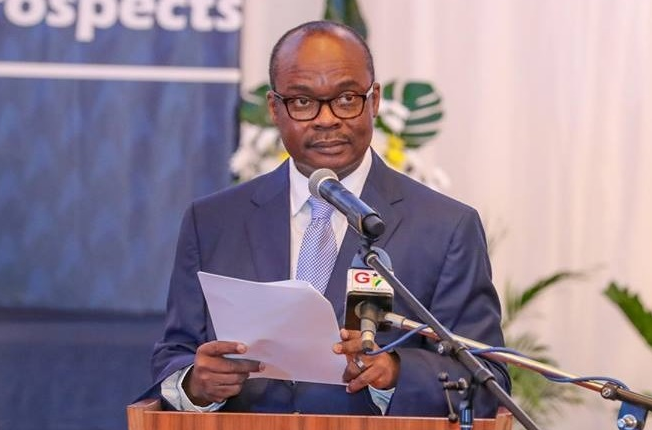

FULL TEXT: BoG keeps policy rate unchanged at 29% after 118th MPC meeting

Good morning, Ladies and Gentlemen of the Media and welcome to the press briefing for the 118th Monetary Policy Committee (MPC) meetings which took place last week. The Committee deliberated and assessed global and domestic macroeconomic developments for the first 4-months of the year, and the balance of risks to the outlook.

A summary of the assessments and key considerations that informed the Committee’s decision on the positioning of the monetary policy rate is as follows:

A. Global Developments and Conditions

1. Global economic activity remains resilient despite sustained monetary policy tightening across advanced economies and Emerging Market and Developing Economies. The global growth outturn of 3.2 percent in 2023, largely reflected stronger consumption spending due to employment growth, particularly in advanced economies, and policy support in China, U.S, and some larger Emerging Market and Developing Economies (EMDEs). Other factors that further supported global activity in 2023, were additions to the stock of capital, a rebound in the manufacturing and services sector, improved trade, and resolution of pandemic era supply chain disruptions.

In the outlook, IMF growth projections point to global growth remaining resilient at 3.2 percent in 2024 and 2025. Downside risks to the growth outlook include the observed slowdown in the disinflation process since early 2024, geopolitical uncertainty, and elevated debt burdens.

2. Global headline inflation remains above target in most countries. Progress towards inflation targets has somewhat stalled since the beginning of the year due to a resurgence in crude oil prices as OPEC+ slashed production and increasing prices in the services sector. This notwithstanding, inflation is projected to decline steadily on the back of tighter monetary policy, softening labour market conditions, and fading effects of past shocks.

3. Central Banks have remained cautious in lowering policy rates due to sluggishness of the disinflation process. Policy rates have been kept elevated to anchor inflation expectations and further drive down long-term inflation rates. Consequently, global financial conditions have generally remained restrictive.

Longer-term bond yields have also risen, due to the expectation of maintenance of a still tight policy stance in the near- term. In the outlook, financial conditions are expected to ease in 2024 as the disinflation process continues and oil prices decline, amid well-anchored inflation expectations.

B. Domestic Macroeconomic Conditions

In the domestic economy, high frequency real sector indicators point to a sustained pick-up in economic activity through the first quarter of 2024. The updated real Composite Index of Economic Activity recorded an annual growth of 2.1 percent in March 2024, compared to a contraction of 6.4 percent in the corresponding period of 2023.

The pick-up in the index was driven mainly by increased imports, private sector contributions to SSNIT, and tourist arrivals. Ghana’s Purchasing Managers’ Index (PMI) signalled an improvement in business activity. As the index rose to 51.3 in April 2024 from 50.9 in March due to improved consumer demand.

4. The latest confidence surveys conducted in April 2024 point to a softening of sentiments. Both Business and Consumer confidence dipped. On the part of consumers, these sentiments were on account of uncertainties about future economic conditions, while businesses expressed concern that recent exchange rate volatility and unstable intermittent power supply situation could significantly raise their operational costs moving forward.

5. The disinflation process remained sluggish over the first quarter of the year. Inflation which declined to 23.1 percent in December 2023, moved up to 25.8 percent by the end of the first quarter of 2024. This slowdown in the disinflation process was driven in large part by rising food inflation, mainly seasonal food crop items.

In April, however, inflation eased to 25 percent on account of improvements in the supply of seasonal food crops which seem to have been countered by increasing non-food inflation from the exchange rate pass through effects. Food inflation declined to 26.8 percent in April 2024 from the high of 29.6 percent recorded in March 2024, while non-food inflation increased to 23.5 percent from 22.6 percent over the same comparative period.

6. Notwithstanding the sluggishness of the disinflation process, underlying inflationary pressures are well contained. All the core measures of inflation monitored by the Bank continued to ease. Isolating price increases of energy and utility items from the consumer basket, core inflation moderated to 24.8 percent in April 2024 from 26.3 percent in March.

7. Fiscal performance is broadly in line with targets agreed under the International Monetary Fund (IMF)-supported programme. Provisional data on the execution of the budget shows that the primary balance (commitment basis) was a deficit of 0.6 percent compared with a target deficit of 0.2 percent. The overall broad budget balance (commitment basis) was a deficit of 1.8 percent of GDP compared with a deficit target of 1.7 percent of GDP.

Total revenue and grants for the period amounted to GH¢30.4 billion (2.9 percent of GDP) compared with a programmed target of GH¢37.7 billion (3.6 percent of GDP). Total expenditures (on commitment basis, including other outstanding payments) for the period amounted to GH¢49.0 billion (4.7 percent of GDP) compared with a target of GH¢55.5 billion (5.3 percent of GDP).

8. Growth in monetary aggregates slowed down considerably, reflecting the Bank’s liquidity management operations to tighten liquidity. Total liquidity (M2+) grew by 29.9 percent in April 2024, on year-on-year basis, compared with a growth of 45.6 percent in April 2023.

The relatively lower growth in M2+ was reflected in all its components, namely, currency with the public, demand deposits, savings and time deposits, and foreign currency deposits. Commercial banks’ reserves with the Central Bank surged following implementation of the dynamic Cash Reserve Requirement (CRR). As at the end of April, 2024 reserve money growth, on a year-on-year basis, had increased to 51.9 percent (mainly due to the changes in regulatory reserves) relative to a growth of 46.5 percent in April 2023.

9. Growth in private sector credit continued to remain weak. Private sector credit growth slowed to 10.8 percent in April 2024 from 19.8 percent in April 2023. In real terms, credit to the private sector contracted by 11.4 percent relative to a 15.2 percent contraction recorded over the same comparative period.

10. Short-term interest rates on the money market broadly showed upward trends. The 91-day and 182-day Treasury bill rates increased to 25.68 percent and 28.03 percent respectively, in April 2024, from 19.67 percent and 22.29 percent respectively, in the corresponding period of 2023. The rate on the 364-day instrument increased to 28.64 percent in April 2024 from 27.04 percent in April 2023.

11. The interbank weighted average rate remained within the policy corridor. The rate increased to 28.68 percent in April 2024 from 25.89 percent in April 2023. In contrast, the average lending rates of banks declined marginally to 31.25 percent in April 2024 from 31.66 percent, recorded in the corresponding period of 2023.

12. Banking sector indicators point to a recovery from the impact of the domestic debt exchange programme. Total assets increased by 28.8 percent to GH¢306.8 billion at the end of April 2024 driven by domestic currency deposits and other funding sources. Banks also reported higher profits for the first four months of 2024, relative to the same comparative period in 2023.

13. Key financial soundness indicators generally improved during the review period. The capital adequacy ratio adjusted for reliefs increased to 15.5 percent in April 2024 from 14.7 percent in April 2023, reflecting the rebound in profits. Capital adequacy ratio without relief for the banking system was 11.5 percent at the end of April 2024 compared to 7.6 percent in April 2023.

Liquidity and efficiency indicators also improved in April 2024, compared to the same period last year. The non-performing loan ratio, on the other hand, increased to 25.7 percent in April 2024 from 18.0 percent in April 2023, due to the lagged effect of COVID-19 pandemic and the economic crisis of 2022 which has led to the downgrading of several large exposures of banks. The sector is expected to be strengthened as banks recapitalise and enforce stringent credit underwriting standards.

14. On the international commodities market, prices of Ghana’s major exports (cocoa, gold, and crude oil), recorded gains in April 2024. Cocoa prices continued to increase, reaching US$10,116.9 per tonne in April 2024, from US$4,235.60 per tonnes in December 2023, representing a year-to-date gain of 138.9 percent.

Crude oil prices increased by 15.2 percent on a year-to-date basis to US$89.00 per barrel in April, compared to US$77.26 per barrel in December 2023. Gold prices also increased by 14.7 percent at the beginning of the year to US$2,334.2 per fine ounce.

15. The balance of trade recorded a lower surplus of US$744.3 million for the first four months of the year, compared to a surplus of US$1.39 billion in the corresponding period of last year. Total exports increased by 4.9 percent to US$5.83 billion driven mainly by significant growth in gold exports and a modest increase in crude oil exports.

Earnings from gold exports increased by 37.0 percent to US$2.97 billion, due to higher volumes of exports from small-scale gold production. The value of crude oil exports, in comparison, increased by 9.4 percent to US$1.27 billion, on the back of both volume and price increases. Exports of cocoa, both beans and products, dropped by 49.0 percent to US$599.3 million.

Other exports, including non-traditional exports, also decreased by 6.0 percent to US$981.8 million. Total imports increased by 22.2 percent to US$5.08 billion, driven mainly by non-oil imports which went up by 31.2 percent to US$3.53 billion, while oil imports increased by 5.6 percent to US$1.55 billion.

16. Provisional data for the first quarter of the year resulted in a current account surplus of US$372.12 million. This represented a 40.8 percent decline from the surplus of US$629.01 million recorded in the first quarter of 2023.

The lower surplus was driven mainly by higher imports, and increased income payments. Net income payment was US$727 million for the first quarter of 2024, compared to net income payment of US$508 million in 2023. Remittances inflows increased sharply to US$1.44 billion, compared with net inflows of US$980 million over the same comparative period

17. The Capital and Financial account recorded a net outflow of US$113 million, lower than a net outflow of US$998.40 million recorded in the same period in 2023. The reduced capital outflows were largely driven by significant inflows from the IMF and World Bank, as well as improved FDI flows to the economy.

18. These developments resulted in an overall Balance of Payment surplus of US$84.74 million in the first quarter of 2024, compared to a deficit of US$586.99 million in 2023.

19. Gross international reserves position remained strong. At the end of April 2024, the stock of Gross International Reserves increased to US$6.59 billion representing 3.0 months of import cover, compared with US$5.91 billion (2.7 months of import cover) at end-December 2023. Gross International Reserves (excluding encumbered and petroleum assets) also increased to US$4.32 billion, compared with US$3.66 billion at end-December 2023.

20. The exchange rate has recently come under some pressure, especially in the forex bureaux market. The pressure in the foreign exchange market reflected increased demand for higher imports, energy sector payments, and uncertainty surrounding the progress of debt restructuring negotiations with external creditors. These conditions have fed into sentiments and contributed to additional pressures. On a year-to-date basis, the Ghana cedi depreciated by 14.6 percent against the US dollar as at 22nd May, 2024 compared to 21.8 percent depreciation for the first five months of 2023.

C. Summary and Outlook

21. Global growth remains relatively strong, bolstered by an expansion of economic activity in large economies, despite the tight monetary policy stance. For the year so far in 2024, progress toward attaining inflation targets globally has somewhat stalled as oil prices have risen due to escalating geopolitical tensions. For emerging markets and developing economies, the strengthening of the US dollar and the tight monetary policy stance of the U.S. Fed have induced more headwinds to the disinflation process.

Due to these developments, central banks have mostly been cautious to loosen their tight monetary policy stance. In the outlook, however, central banks are expected to start the easing cycle when inflation begins to steadily decline towards targets.

22. The Bank of Ghana’s high-frequency real sector indicators pointed to steady improvement in economic activity evidenced by continued steady growth in the CIEA. Similarly, the Purchasing Managers’ Index (PMI) firmed up, driven by resilient consumer demand. On the contrary, real private sector credit remains generally weak, while business and consumer confidence softened, reflecting concerns about high cost of raw materials and foreign exchange market pressures.

23. Ghana’s external sector position remains strong although the current account surplus nearly halved in the first quarter of the year. The performance in the current account reflects a rebound in imports and net income payments. Accumulation of reserve buffers remains on course and set to exceed the programme expectation in June, largely due to the domestic gold purchase programme. The Bank’s reserve at end-April 2024 currently stands at 3.0 months of import cover.

24. The exchange rate pressures witnessed in recent weeks reflect a weakening of the current account surplus, due to higher import demand and lower export revenue, especially a sharp fall in cocoa export earnings. The foreign exchange market pressures also reflect robust public spending on IPP arrears payment, and capital expenditure outlays.

There are also indications of increased pressures from importers diverting foreign exchange demand requirements into informal markets, increasing speculative demand for foreign exchange.

The Bank of Ghana, however, has adequate reserves to manage these shocks to the foreign exchange market, having added over US$600.0 million to the current foreign exchange reserve levels over the first five months of the year. The improved reserves position is also backed by strong liquid monetary gold levels of over 26.6 tonnes (estimated at US$2.1 billion) as a result of the very successful domestic gold purchase programme.

25. The Bank of Ghana remains fully committed to provide stability in the exchange rate for the cedi. The Bank has enough foreign exchange reserves to support the market and economic agents should stop engaging in speculative purchases as they will suffer economic losses when the correction occurs.

26. The Bank of Ghana is taking measures to improve market conduct and instill sanity in the market for foreign exchange. To this end, the Bank has worked with the Ghana Association of Banks to streamline documentation requirements for foreign payments to minimise the incentives to resort to the informal markets.

To deal with the high demand pressures on the foreign exchange market, the Bank has taken steps in the past few weeks to directly absorb foreign exchange needs of some corporate institutions, and this has led to a reduced pipeline demand for foreign exchange from the commercial banks.

The Bank is fully aware of the operations of illegal operators in the foreign exchange market and is working with the Financial Intelligence Centre to sanitise the foreign exchange market. Foreign exchange bureaux monitoring will be stepped up to ensure compliance with their regulatory framework. In line with this, all foreign exchange bureaus advertising rates outside their premises and on social media platforms must immediately desist from the practice. The Bank has set up a task force to monitor all the foreign exchange bureaux to ensure compliance.

The foreign exchange market is also affected by sentiments and pronouncements made in this election year and we urge all to manage pronouncements which weakens confidence in the local economy.

27. On fiscal policy, expenditures outpaced revenue growth in the first quarter, reflecting the frontloading of IPP arrears payments. Maintaining strict fiscal discipline for the rest of the year will be crucial to strengthen confidence in the economy.

28. On general macroeconomic conditions, the committee was of the view that while implementation of policies—at the macro and structural reform level — are consistent and align well with the tenets of the IMF-supported programme, there is the need to ensure that the recent depreciation of the currency does not become embedded into the pricing behaviour of businesses and on inflation expectations.

The strong reserve build-up of about US$2.0 billion since the beginning of the IMF programme, the strong disinflation process, significant progress on fiscal policy consolidation, positive current account balances, and the good progress on the external debt restructuring process, have all worked together in concert to deliver enough buffers to support the exchange rate.

29. The latest forecast shows a slightly elevated inflation profile on account of recent exchange rate pressures and adjustments in transportation fares. However, the projections show that inflation will remain within the monetary policy consultation clause of 13-17 percent at the end of the year.

These forecasts are contingent on sustaining the tight monetary policy stance, including aggressive liquidity management operations. 30. Given these considerations, the Committee decided to maintain the Monetary Policy Rate at 29.0 percent

Source: www.ghanaweb.com