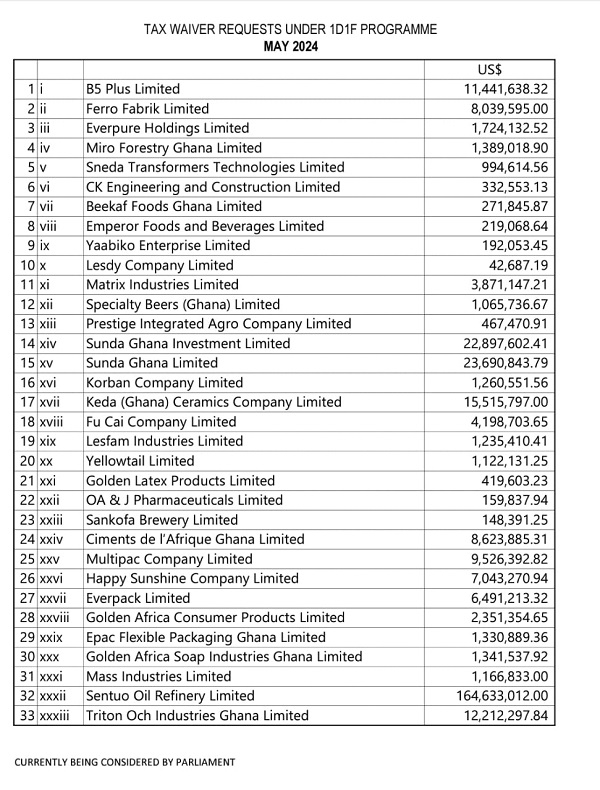

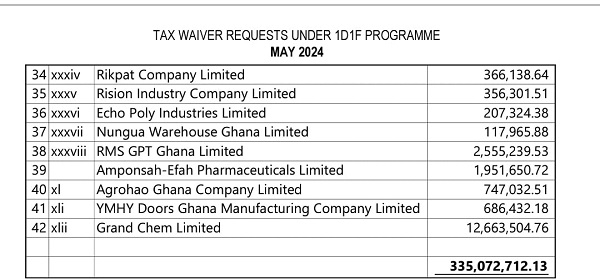

Full list of beneficiaries under consideration for $335 million 1D1F tax exemptions

In 2021, the Ministry of Finance began the process of granting approximately $335,072,712.13 in tax exemptions to 42 companies as part of the government’s One District One Factory initiative.

The proposal was presented to Parliament in 2022 by the former Minister for Finance, Ken Ofori-Atta, under The Exemptions Act, 2022 (Act 1083).

This led to a deadlock in Parliament between the two sides of the House over the request for tax exemptions for these 42 companies.

The Minority claimed that the exemptions were a cover for corruption, accusing the ruling government of trying to give the exemptions to their allies and cronies.

However, the Minority in Parliament argued that businesses participating in the One District One Factory initiative needed tax exemptions to succeed in their ventures.

They also stated that the tax exemptions, if approved, would not only boost economic growth but also attract significant investments into the economy.

On May 17, 2024, the Majority presented the request for tax exemptions to Parliament once more for consideration.

Among the companies listed, the newly established Sentuo Oil Refinery Limited is set to receive the highest amount of $164,633,012.00 if approved by the House.

See the full list of potential beneficiary companies:

Source: www.ghanaweb.com