Five simple and effective saving strategies for hard times

With the current economic challenges in the country, one of the hardest things to do is saving. Not only is putting money aside prudent, but maximising those savings is crucial for setting financial stability goals.

In 2022, Ghana’s inflation surged to 54 percent, impacting the average income, salaries, and livelihoods of many citizens. Despite inflationary pressures easing somewhat in 2024, with the current figure pegged at 20.9% in July 2024, saving remains a challenge for many.

Maximising savings involves adopting strategies to reduce expenses, optimising budgets, and making informed financial decisions. This includes various measures such as investing wisely, being financially disciplined, cutting down on non-essential spending, prioritizing debt repayment, and taking advantage of discounts.

When properly implemented, these methods could help individuals build the necessary financial cushion while improving their financial stability, despite economic uncertainties.

GhanaWeb Business, in this article, provides a step-by-step guide that can help you develop a simple and realistic strategy for saving.

1. Record your expenses

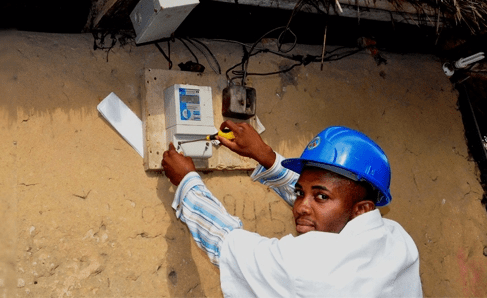

One of the first steps to saving money is to figure out how much you spend. It is essential to track all expenses incurred, including regular utility bills, household purchases, and more. Keeping a record of your expenses on paper, a notebook, or a tracker app can help track your daily or monthly expenses.

2. Create a budget and include savings

Once you have enough information about how much expenses you incur within a month, you can begin to create a budget relative to your income. This can help you plan your spending and limit overspending.

It is important to factor in expenses that occur regularly but not every month, such as miscellaneous or unplanned spending like car maintenance etc. Once you have a fair idea of this, you can eventually plan to save an amount that feels comfortable to you.

You can also ramp up on your savings by setting aside about 15 to 20 percent of your income per month.

3. Deliberately cut down on spending

To maximise your saving goals and consolidate gains made, it is vital to trim down non-essential spending.

This could include activities that are not immediately important as you look for ways to save on fixed monthly expenses such as water and electricity bills, car insurance, entertainment, etc.

One major way of trimming down non-essential spending is to ‘Wait Before You Buy’ as you may realise that the item or activity was wanted rather than needed, giving you the space and time to plan towards it.

4. Set realistic saving goals

One of the surest ways of saving is by setting realistic saving goals in the short to long term (one to three years). Setting these goals could help you estimate how much money, time, and how long you will need to save towards that goal or purchase.

5. Outline your key financial priorities

Priorities they say differ for every individual as it is important to put things into perspective by order of priority and make the needed push for savings and investments towards that priority.

Finally, you could put money aside for the future, but be sure to remember long-term goals and planning are important to give you a clear idea of how to allocate your savings.

Source: www.ghanaweb.com