Finance minister engages 22 banks on DDEP, T-bills, government spending

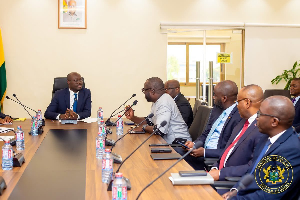

The Minister of Finance, Dr Cassiel Ato Forson, has engaged the Managing Directors of some 22 banks on the state of the country’s financial space.

According to him, the conversations were centred around interest rates, the Domestic Debt Exchange Programme, and the monetary policy situation in the country.

In attendance was the Governor of the Bank of Ghana, Johnson Pandit Asiama, the President of the Ghana Association of Banks (GAB) and the CEO of Stanbic Bank Ghana, Kwamina Asomaning.

Sharing insights from the meeting on his page on X on March 20, 2025, Ato Forson wrote: “It was a candid and constructive conversation about the heavy lifting required to restore macroeconomic stability and foster sustainable growth. To that end, we are making massive investment cuts and resetting goods and services expenditure to 2023 levels. Our target is clear: achieve a primary surplus of 1.5% as we work to consolidate our gains and rebuild confidence.”

The minister said his outfit will present a spending rule to parliament to deter wasteful expenditure and irrational government spending.

He also assured that the government is committed to fulfilling debt obligations in the debt restructuring programme.

“As part of our commitment to fiscal discipline, we will be submitting to Parliament a fiscal responsibility rule, a debt ceiling that the Ministry of Finance cannot exceed. On the Domestic Debt Exchange Programme (DDEP), let me be unequivocal: We do not intend to default. All outstanding holdouts have been paid, and we have built enough buffers to fully meet our DDEP obligations this year,” he added.

On the government borrowing, he said: “We are also taking deliberate steps to reduce our reliance on the Treasury bill market and strengthen policy coordination between fiscal and monetary authorities. Stability is our priority, and we will not return to the turbulence of 2022. We will not be reckless.”

The minister added: “Most importantly, we need each other. The banking sector is a crucial partner in our development agenda, and we want to work with you to build a resilient financial system that fuels economic transformation.”

Source: www.ghanaweb.com