Coronavirus: Policy makers face uncertainties amid second wave

Amid the second wave of the coronavirus pandemic, policy makers currently face uncertainties on how the economy will respond, Director of Research and a member of the Monetary Policy Committee of the Bank of Ghana, Philip Abradu-Otoo, has said.

Although the country’s economic growth has been projected by international ratings agency Moody’s to recover to 4 percent this year, there are key challenges to the outlook, such as diminished fiscal space, government’s financing constraints as well as threats of the pandemic’s second wave, after a surge in infections since late December.

The country’s revenue to GDP ratio, which is below 20 percent, is a major concern for the economy given government’s huge expenditures amid the pandemic.

“We need to brace ourselves for what lies ahead in the year 2021. I think the key question hanging on our neck is whether fiscal and monetary policies have enough room to be able to accommodate this new era we seem to be entering,” Mr. Abradu-Otoo said in an interview with Business24.

“At this stage where the level of uncertainties seems to be very high, we would require more vigilance and coordinated activities, and we need to converge and confront this new challenge that is emerging,” he added.

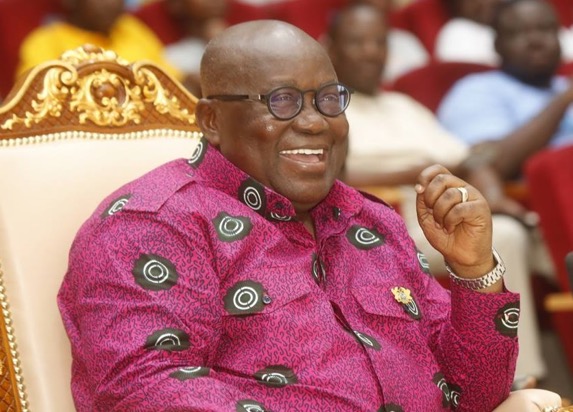

Some health experts have opined that although an immediate lockdown is not what the country needs to suppress the resurgence of coronavirus infections—with active cases about tripling since December—it would be appropriate for President Akufo-Addo to impose restrictions on movement.

The President, in his last national address on the pandemic, warned he would be forced to lock down parts of the country again should citizens continue to disregard the anti-virus protocols.

“From where I sit, I see this year a little bit more complex than what I saw last year. There is no clarity on the way forward, because just when we thought that the COVID-19 pandemic was easing, then a second wave emerges. We don’t know how the economy is going to react to this second wave,” Mr. Abradu-Otoo said.

“It’s too early yet in the year. We need a little bit more time to see what will happen in the first quarter, and then use that as a basis to look ahead till the end of the year,” he added.

The Research Director further noted that there is no intention currently of triggering another asset purchase programme by the central bank.

He said the fact that the 2021 budget is yet to be presented to Parliament adds to the uncertainties this year.

Some analysts say investors are keenly awaiting government’s fiscal policy direction as well measures to be taken to address the sustainability of the public debt stock.