Brent crude price jumps to $94 as oil market rallies

China’s annual CPI reading moved back into positive territory and new loans improved, traders are seemingly cautious about the outlook so are refusing to get carried away with the figures.

Oil prices have also been tearing higher again in recent weeks, aided by the Saudi/Russian decision to extend output restrictions until the end of the year. Brent is now trading around $90 where it has stalled over the last week.

A sustained break above here would be a big psychological move and trigger a lot more speculation about triple-figure oil again, something we haven’t seen in a year and could complicate the inflation and interest rate outlook, according to ING.

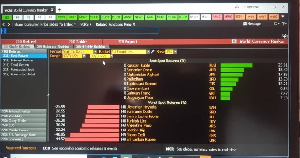

Market data showed that International benchmark Brent crude traded at $94 per barrel, on Friday, increasing by around 3.7% relative to the closing price of $90.65 a barrel on Friday last week.

The American benchmark West Texas Intermediate (WTI) gained while trading at $90.54 a barrel, a 3.46% increase over last Friday’s session, which finished at $87.51 a barrel.

Both benchmarks hit their highest levels since November 2022 during the week as investors fretted about tightening supplies following Russia and Saudi Arabia’s plans to limit output until the end of the year.

Oil prices spiked to a fresh 10-month high of $92.40 a barrel on Tuesday, bolstered by supply disruptions in Libya. Catastrophic flooding caused by Storm Daniel killed at least 5,300 people and compelled Libyan officials to close four oil terminals as a precaution.

OPEC published its monthly oil market report on the same day, supporting the upward demand trajectory. According to the report, ongoing global economic growth is forecast to drive oil demand, especially given the recovery in tourism, air travel and steady driving mobility.

The US Energy Information Administration (EIA) revised up the price of Brent crude for this year and next in light of the expected decline in global oil inventories, further supporting the narrative of high oil prices for the coming months.

The price of Brent crude will average $93 per barrel in the fourth quarter of this year, the agency said.

Data indicating an increase in oil demand and consumption in China, supported by the economic recovery, pushed prices higher on Friday.

Better-than-expected economic data in China and reports of record oil consumption supported the view that demand will continue to increase in the world’s biggest crude importer.

Source: dmarketforces.com