BoG, finance ministry to sign MoU on central bank recapitalization – Dr. Addison

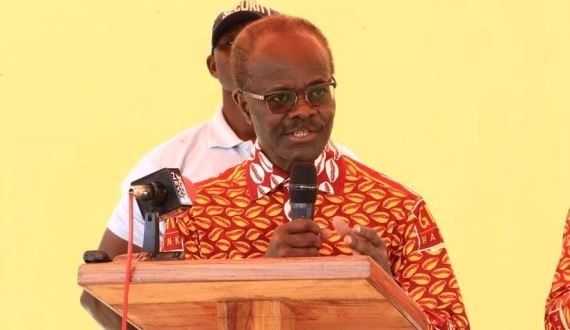

Bank of Ghana governor, Dr. Ernest Addison, has said discussions have been had with the just-ended IMF Mission team to Ghana on the impact of the Domestic Debt Exchange Programme (DDEP) and the losses incurred on the central bank’s balance sheet.

The central bank in its annual financial statements for 2022 revealed that it had incurred a total loss of some GH¢60.8 billion, additionally leaving a negative equity of GH¢55.12 billion as against a positive equity position of GH¢5.7 billion recorded a year earlier.

The central bank has occasionally attributed the losses to the government’s DDEP which significantly impacted its balance sheet for the period.

To further address the situation, Dr. Ernest Addison said a broad understanding has been reached on the early recapitalization of the Bank of Ghana with an MoU set to be signed with the Ministry of Finance to this effect.

He said: “During the period while the mission was here, we have also addressed some burning issues including the impact of the DDEP on the balance sheet of the Bank of Ghana and we have reached a broad understanding on early recapitalization of the Bank of Ghana and a Memorandum of Understanding between the Bank of Ghana and the Ministry of Finance will be signed to this effect.”

Dr. Addison made this known speaking at a joint IMF, Finance Ministry and BoG presser held in Accra on April 13, 2024, which announced that Ghana had reached a staff-level agreement with the IMF on a second review of the 17th bailout programme.

The central bank governor further said discussions have progressed on the external debt restructuring programme of the government while negotiations with commercial creditors, bondholders and bilateral creditors remain ongoing.

Source: www.ghanaweb.com