BoG declared as 2019 Central Bank of the Year

Ghana’s central bank, Bank of Ghana (BoG), has been named winner of the 2019 Central Banking Awards.

The global awards scheme’s report stated that BoG demonstrated its strengths with the delivery of a major banking sector and the microfinance clean-up operation.

It added that the BoG has had an impressive record of achievement, but the most notable is its reform of a seriously undercapitalised and poorly managed banking sector.

It noted that the central bank has also dealt with a complex set of risks, which could have caused serious damage to the country’s economy.

Aside from this, the Central Banking Awards noted that BoG still faces challenges on multiple fronts, for which it ensures the recapitalisation of some of the banks.

“The banking sector also has to digest a large proportion of non-performing loans, and IMF officials have called for closer regulation of the country’s non-bank finance sector. But the performance of the central bank during the past three years indicates the institution is well placed to meet such challenges,” the report said.

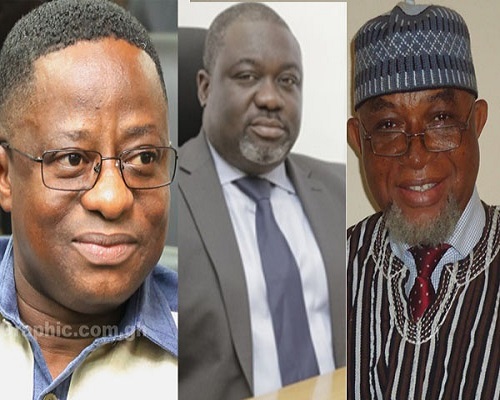

The Central Banking Awards scheme further lauded Governor Dr Ernest Addison for the reforms in the country’s banking sector immediately after his appointment.

The financial system according to the Governor reached a tipping point and “we could not just have assumed business as usual. The central bank soon closed two lenders, but that was only the start of its activity”.

At the start of Addison’s tenure, there were 35 commercial banks operating in Ghana. By January 2019, less than two years into his governorship, there were only 23. Some banks were merged, while others have had their licences withdrawn. The central bank also took radical action in the microfinance sector, shutting down several hundred small lenders. “These moves marked a sharp break with previous policy,” the scheme said.

Dr Addison in December 2018 criticized his predecessors for their continuous provision of “liquidity support to these weak failing banks, without addressing the underlying problems that led to the illiquidity and insolvency of these institutions.”

He noted that there were serious faults in the way the banks were managed because several of the management teams in Ghana’s banking sector had obtained banking licences through “false pretences” whilst others had removed very large sums of money from the banks they owned.

The BoG, however, worked to increase the demands of its supervisory staff as they worked on creating legally defensible and operationally feasible plans to take over the banks.

The Central Banking Awards will be held on March 19, 2020, in Brussels, Belgium.

Source: www.ghanaweb.com