South Africa’s biggest employers faces shutdown

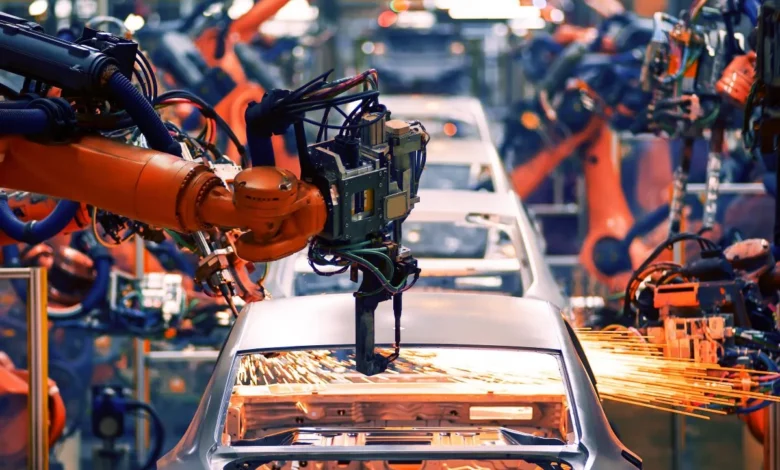

The National Union of Metalworkers of South Africa, the country’s largest labor group, is demanding employers including BMW South Africa and the local units of Toyota and Ford give workers 10% raises ahead of talks that will agree wages for the next three years.

While that’s more than three times the annual inflation rate, it’s the union’s lowest initial ask in at least four negotiation cycles and comes as several headwinds threaten the long-term viability of manufacturing vehicles and components locally.

They include:

- Heightened global uncertainty due to fears of a wider war in the Middle East and higher US tariffs;

- South Africa’s potential exclusion from a trade deal that gives African nations preferential access to the world’s biggest economy;

- A shift to electric vehicles in key export markets; and

- A flood of cheap imports.

South Africa is the world’s most unequal country and its economy has barely grown over the past decade.

Still, the automotive sector remains a key driver of output, accounting for about 5% of gross domestic production.

Averting a fourth-consecutive deadlock in pay talks and a potential strike by more than 100,000 workers is seen as key for the survival of an industry that has long been hobbled by electricity-supply constraints and logistics challenges.

“The economy isn’t performing well and a flat 10% increase along with some of the other challenges will negatively impact the performance of businesses,” said Siyabonga Mthembu, a partner at BDO South Africa.

“International companies operating in South Africa’s automotive sector are particularly at risk and will have to consider survival strategies such as market diversification.”

“Sometimes, looking at pay in isolation of other factors at play can be very dangerous and I think all the parties need to sit around a table and understand the entire ecosystem.”

Phakamile Hlubi-Majola, Numsa’s spokesperson, has said that asking for an inflation-linked increase is “unrealistic” because its members are struggling to survive.

Representatives for employers associations declined to comment as formal wage negotiations have yet to begin.

Price-Sensitive Buyers

A sluggish economy has also driven a shift in the new vehicle market, with consumers increasingly buying imported vehicles.

Almost 62% of light vehicles purchased in South Africa last year sold for less than 500,000 rand ($27,588), according to Paulina Mamogobo, the chief economist at Naamsa, The Automotive Business Council.

Industry association data show global trade wars are also weighing on exports, which account for about two thirds of vehicles produced in South Africa.

While higher tariffs imposed by the US on imported vehicles and components only took effect in April, shipments to North America had already declined 73.2% year-on-year in the three months through March.

Given changes in the operating environment, key players in the industry have asked the government to bring forward a review of its production-incentive program and so-called industry master plan to 2025, Mamogobo said.

Naamsa is already working with its members on potential evidence-based solutions to address the challenges they are facing, he added.

Lesego Moshikaro-Amani, a senior economist at Trade & Industrial Policy Strategies urged the government to consider adopting policies that promote local battery production for electric vehicles, mineral processing and refining for the automotive industry and measures to “aggressively attract new manufacturers.”

Local manufacturers could also benefit from producing more affordable vehicles, including two and three wheelers, for export into Africa, she said.

Source: Business Tech