55 Years, $10 Million Revenue, $200 Million Clean-Up: The Saltpond oil field story

The Vice President of policy think tank IMANI-Africa, Bright Simons has revealed that Ghana may have to pay hundreds of millions of dollars to decommission an oil field that has not been particularly beneficial to the country.

He stated that the costs involved in decommissioning the Saltpond Oil Field, which has been in operation for 55 years but has generated less than $10 million, are inching toward $200 million.

In a write-up on his X page dated January 15, 2025, he explained, “Decommissioning is just a fancy word for cleaning up an oil field of its abandoned equipment and facilities after production has ceased.”

Breaking down what led to the losses Ghana is currently facing, he explained that the oil field no longer produces oil and must be cleared as it poses a danger to the environment.

He detailed events from 1970, when production first began, to date as follows:

1. We like to say that Ghana first started producing oil on a commercial basis in 2010, after Jubilee’s discovery in 2007. This is not entirely accurate. As far back as 1970, a commercial discovery was made at Saltpond by a consortium known as Signal Amoco.

2. But the quantity of oil found was small and the companies shied away from investing enough money. The Saltpond field was thus passed to Agripetco, which also struggled to make enough money from it.

3. In 1984, the government handed it over to PFI but nothing much became of that arrangement, so in 1985 the field was shut down.

4. In 2000, it was revived and an agreement signed with Lushann, run by a Ghanaian based in Texas and two Nigerian partners. He tried to milk it for what it was worth. But by 2015, it was clear that the whole setup was a mess and the field was shutdown again. In 2016, Lushann’s agreement, initially scheduled to end in 2024, was cancelled.

5. Between 1970 and 1985, the field produced about 3.55 million barrels of crude oil. Between 2000 and 2015, it produced about 1.4 million barrels of oil. Had it even been the case that the companies who operated the field were conscientious in paying their taxes and royalties, Ghana would have earned about $60 million over the 45-year period.

6. Unfortunately, the companies were not consistent. There were many years during which nothing at all was paid. For example, between 2002 and 2011, Lushann refused to pay most of what it owed to Ghana citing poor cashflow.

7. When the government sat up and pushed hard, royalties totaling about $500,000 were paid for the 2 years of 2012 and 2013, but not the taxes and dividends. Lushann said they just couldn’t afford.

8. I estimate that over the 55-year period of its existence, adjusted for inflation, the government has, on behalf of Ghana, earned less than $10 million from Saltpond, even after adjusting for inflation.

9. Meanwhile, the main jack-up rig in the field, which is in the sea offshore Saltpond, by the way, has been rotting. It is said to pose a danger to vessels and wildlife. Under Ghanaian law, after profitable oil has been depleted, the investors operating the field have to clear off the equipment and facilities. Because Saltpond field has always been managed by deadbeat investors, those costs now fall on Ghana.

10. Between 2016 and 2018, Pap Energy was contracted and paid to do all the preliminary work to lay the grounds for the decommissioning/clear-up.

11. This being Ghana, the new government that took over in 2017 wasn’t going to rely on something done in the previous government’s term. They decided to engage fresh consultants, but this time they added project management to the scope. The three million dollar contract was to ensure sound operations in the removal of the “Mr. Louie” jack-up rig installed in the Saltpond field by Agri-Petco in the 1970s. Alas, this was not to be. The primary contractor, Hans & Co., buoyed by their political connections, refused to cooperate. Thus, the contract was never executed.

12. In 2022, the main contract for removal was awarded to Hans and Co to the tune of $96 million. By 2024, $89 million of the amount had been logged as spent. The contractor was however still owed $3.7 million.

13. The bulk of the work done by Hans & Co involves pumping cement into various components of the rig structure in order to seal and plug any potential leakages, whilst maintaining structural integrity.

14. In October 2023, the work was suspended and a few months later the Hans and Co crew left the country. The contractor claims that it can’t continue to remove the physical structures without more money.

15. How much more money do they say is needed? A whopping $81.11 milliion!

16. What I am telling you is that to remove a rotten rig from offshore Saltpond, Ghana is very close to spending $200 million! For an oil field that has not generated even up to $10 million in 55 years!

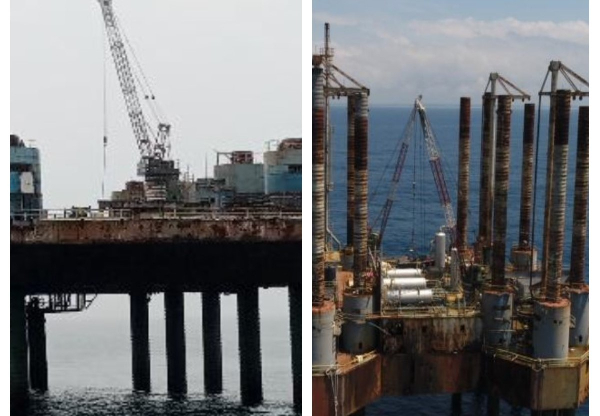

17. By the way, the picture on the left is how the rig looked before the roughly $100 million was spent on the project. The one on the right is how it looks like now. You can proceed to ignore the lighting contrast. Thank you.

Bright Simons concluded by lamenting that situations like this make being a policy analyst in Ghana a “big headache.”

SSD/MA

See the tweet below

Source: www.ghanaweb.com