BRICS: JPMorgan Says Alliance Growth ‘Can’t be Ignored’

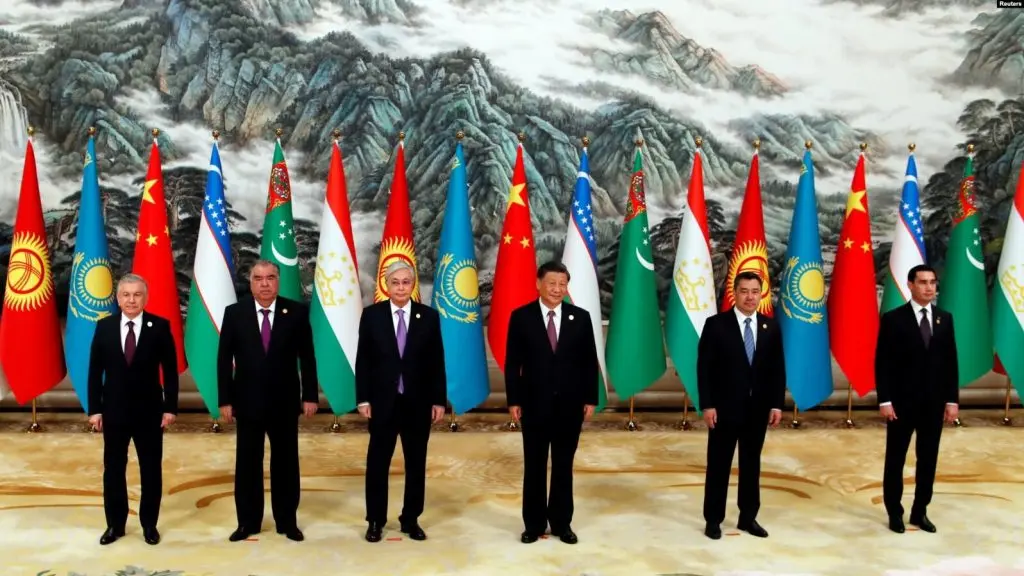

Leenart referenced China as an economic powerhouse whose importance to global finance was an unavoidable reality. With India’s global GDP set to continue ascending over the next several years, the alliance is in a prime position to continue establishing its strength within the international finance arena.

JPMorgan Lauds BRICS Economic Status as Global Power

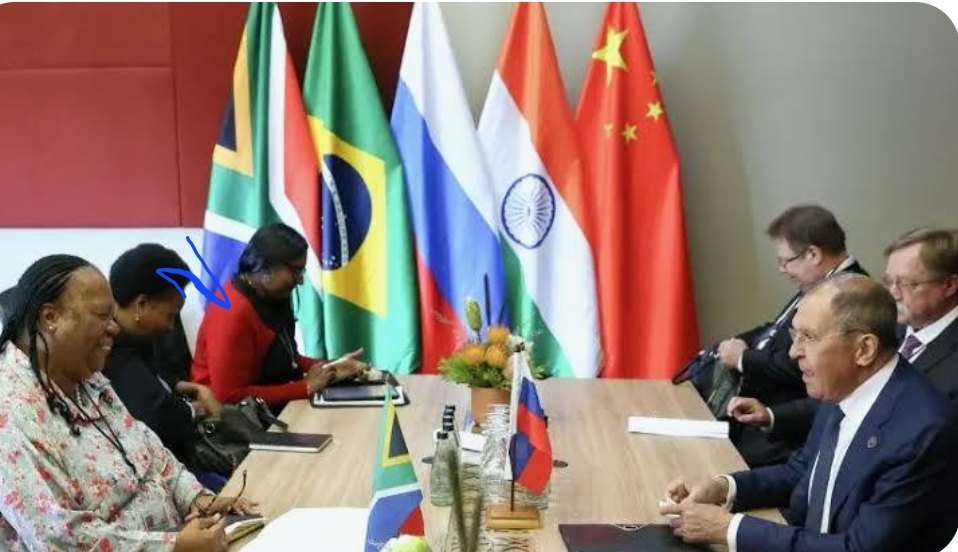

Over the last several years, the geopolitical realm has seen an undeniable ascension of the BRICS economic alliance. Facilitated by the weaponization of the US dollar enacted in 2022, the bloc embraced unilateral relations to improve its economic hegemony. Meanwhile, it integrated de-dollarization initiatives to further institute change amid the global hierarchy. Therefore, reinforcing its seeking to procure a path to a multipolar world.

Those efforts were only magnified last year when the alliance welcomed five countries into the fold. The collective’s first expansion effort since 2001, the bloc embraces greater power in vital sectors like oil and overall exports. Now, there is a clear indication of a shifting global status amid the current world order.

With those BRICS developments taking place, the JPMorgan Asia Pacific CEO has noted the alliance growth “can’t be ignored.” Speaking to CNBC, Sjoerd Leenart discussed China’s ascension specifically, and its development into an undeniable global juggernaut.

“You can’t ignore it; you have to do business there. Even if you decide not to do business there, you still need to understand what’s going on,” Leenart said. Furthermore, he noted the country’s ability to influence, “every industry around the world.”

China is not the only alliance member with tremendous growth prospects. Indeed, India is expected to enter the top 3 global economies by the year 2028. That development will see the BRICs bloc lead those three nations, with China and India joined by the United States.

Moreover, the latter is facing its own set of issues. The US is contending with increasing inflation, and although that is certainly a global issue, the debt figures have made the economic fragility undeniable. JPMorgan CEO Jamie Dimon recently expressed his expectation of a hard landing for the US, while also speaking of China’s immense growth prospects.