Cameroonians fight their government over 0.2% Mobile Money tax

Cameroonians oppose new tax

The 0.2% MoMo tax took effect on January 1, 2022

Opponents use Twitter to protest

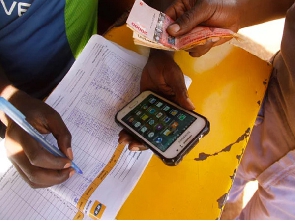

Cameroonians started the New Year with a new tax and it was the mobile network operators that sent them a reminder of the particular tax.

That tax is the 0.2% Mobile Money tax, which is expected to be levied on the transfer and withdrawal of money via the platform.

One network provider circulated the following message to subscribers: “Dear valued client, in the application of the Finance Law, starting 01 January 2022, a 0.2% tax is applied to transfer and withdrawals. Thanks for your understanding.”

Here in Ghana, it took the stiff opposition of Minority lawmakers to torpedo the Electronic Transactions Levy (E-levy) Bill. Ghanaians would have started the year with a similar tax component pegged at 1.75%.

When Parliament reconvenes later this month, it is expected that processes will be undertaken by the government side to pass the Bill into law.

The NDC has stressed its continued opposition to the levy that was contained in the 2022 budget presented in Parliament by Finance Minister Ken Ofori-Atta in mid-November.

Cameroon’s Mobile money law<>

A leading business news portal, Busines in Cameroon, summarized the tax as follows: “According to the 2022 finance law, the tax applies to transactions carried out through all the traceable technical platforms (like internet, mobile phone, wire order, telex, fax) except for bank transfers and electronic transactions carried out to pay tax and customs duties.

“The tax will also be applied to cash withdrawals from financial institutions or mobile telephony operators,” it added.

On social media, Cameroonians are livid at the tax with the reason that the mobile money component in particular was unfair in many ways.

What Ofori-Atta said about 1.75% levy on electronic transactions

Ken Ofori-Atta introduced a new 1.75% levy on all electronic transactions such as Mobile money transactions, remittances and other electronic transactions.

Fees and charges of government services have also been increased by 15%.

The Finance Minister explained, “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.

“As such government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient.

“To safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day, which is approximately ¢3000 per month, will be exempt from this levy,” Ofori-Atta revealed.

#EndMobileMoneyTax: Twitter campaign against tax

One of the key voices against the tax is Rebecca Enonchong, a leader in African tech ecosystem, who tweeted as follows: “Can you imagine being charged a tax to withdraw your own cash out of your account? For millions of Cameroonians who hold their money in mobile money wallets, this became a reality on Jan.1.

“This tax is regressive and will slow financial inclusion. #EndMobileMoneyTax. #WeSayNo.”

Arrey Ntui, a security analyst with the Crisis Group also highlighted the draconian nature of the tax via a tweet: “Cameroon should pursue financial inclusion as cost of living skyrockets. The mobile money tax unfairly punishes Cameroon’s poorest people.

“Cheque and bank transfers have no similar tax. Over four million humanitarian aid needers rely mostly on mobile money,” he added.

Below are some reactions on Twitter

Source: www.ghanaweb.com