Seven reasons why Ghanaians will be worse off under 2021 budget – Ato Forson

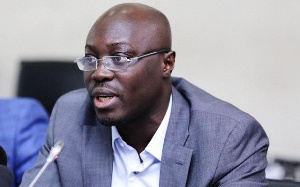

Minority spokesperson on Finance, Cassiel Ato Forson has enumerated seven reasons why the 2021 budget will make Ghanaians worse off under the Akufo-Addo government.

The Energy Sector Recovery Levy, COVID-19Health Levy, and Sanitation and Pollution Levy are some of the revenue generation measures announced by the Caretaker Finance Minister Osei Kyei-Mensah-Bonsu in the 2021 budget.

In the three-hour-long address, the minister also announced over 5% financial sector levy to cater for the banking sector clean-up. Road tolls will also see an upward adjustment.

The government has, however, justified the introduction of the three levies in the 2021 budget statement.

But Mr. Ato Forson says Ghanaians will be worse off now than during the height of the pandemic

Below is his post on his Facebook page

7 Reasons why Akufo Addo’s 2021 budget will worsen the plight of Ghanaians!

1. We need to make a clear distinction between Covid-19 impact on the economy and your own Mess.

Yes, Covid19 has done some damage to our Economy particularly the private sector but at the Central government level, the problems we face today are due to mismanagement and the 2020 Election year Expenditure! Here is why:

A. Debt was already rising at an unsustainable level before Covid! The public debt ballooned from 122billion(56% of GDP) to 291.6 billion representing 76% of GDP!

B. The fiscal path deteriorated before COVID

C. Economic growth slowed before Covid

D. Reckless expenditure and corruption became the norm pre- Covid and got worse during Covid!

2. Government has also suspended Fiscal Responsibility threshold till 2024. This means reckless and uncontrollable expenditure will continue unabated till 2024!

3.Tax increases have been coined as revenue-enhancing measures! Now at a time

businesses are struggling and need stimulus to recover the AKUFFO ADDO government’s solution is new taxes. Ghanaians will have to brace up for these hikes in taxes:

A. COVID-19 Health Levy

B. Road Toll increases

C. Gaming Tax Hi Kindly

D. Sanitation and pollution Levy (Bola Tax)

F. 1% Increase in NHIL

G. 1% increase in Vat flat rate

H. ESLA increase-Additional burden on motorists and food prices.

I. Financial sector clean up Levy 5% – The banks are surely passing this on as bank charges to the consumer

4. From production to taxation:

All the policies of this government’s second term are effectively going to derail the productive sectors of the economy.

5. No hope for all government contractors: The budget made only GHS 3.7 billion provisions for the payment of over 40 billion GHS arrears owed to contractors.

6. Capital expenditure for 2021 is estimated at 2.6 percent of GDP as compared to 5.5 % of GDP for the 2020 outturn while recurrent expenditure( effectively: chop chop) is on the increase.

7. No serious investment in the key sectors of the economy including energy, Transport, and Agriculture.

This will adversely affect sustainable inclusive growth.