2025 Budget: GNCCI supports VAT reform, urges clear implementation roadmap

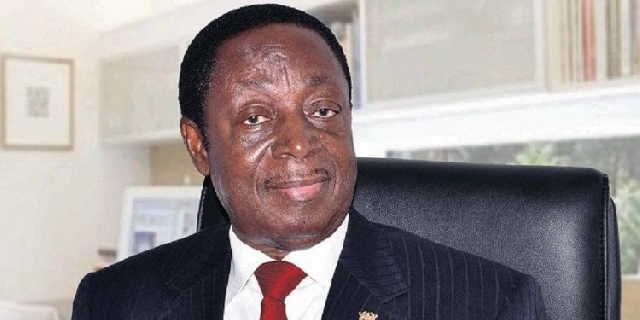

The Chief Executive Officer of the Ghana National Chamber of Commerce and Industry (GNCCI), Mark Badu Aboagye, has welcomed the government’s decision to reform the country’s Value Added Tax (VAT) system.

However, he has raised concerns over the lack of a clear timeline for implementation, warning that the uncertainty could negatively impact businesses.

According to Badu Aboagye, Ghana’s current VAT structure is overly complex, combining standard VAT with straight-line levies such as the National Health Insurance Levy (NHIL) and the Ghana Education Trust Fund (GETFund) levy.

He argued that this setup complicates compliance, increases operational costs, and ultimately contributes to inflation as businesses pass the additional burden onto consumers.

“We have complained that this structure of VAT is not good. It doesn’t give the government or the ministry the necessary revenue because compliance will obviously be low due to the complicated nature of the tax. You don’t combine a standard VAT with a straight-line levy, it’s not done anywhere,” he told The High Street Journal.

In its 2025 budget presentation on March 11, 2025, the government acknowledged the need to reform the VAT system and announced the formation of a committee, in collaboration with the International Monetary Fund (IMF), to review it.

However, Badu Aboagye emphasised that businesses need clarity on when these reforms will take effect.

“They were not specific on when they are going to do that. That’s one of my concerns. But I’m hopeful that the committee they are setting up together with the IMF will move quickly and ensure that the VAT system is reformed to support businesses,” he added.

He further explained that the current VAT structure imposes a heavy tax burden on businesses, as they cannot claim input VAT on some levies, increasing their cost of operations.

This, he noted, forces businesses to transfer the burden to consumers, driving up the prices of goods and services.

For years, the GNCCI has advocated for a simplified VAT system that enhances compliance, boosts government revenue, and supports business growth.

Badu Aboagye therefore urged the government to expedite the reform process to ensure that businesses and the broader economy benefit from a more efficient tax system.

Source: www.ghanaweb.com