Finance

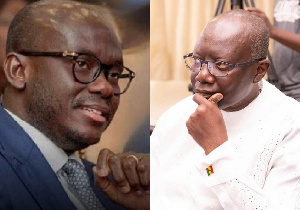

How A-G stopped government from using Executive Powers to impose mandatory Debt Exchange on bondholders

GhanaWeb understands that the Office of the Attorney General advised the government of Ghana from, among other things, imposing a unilateral variation of Collective Action Clauses on bondholders.

The Ministry of Finance in a letter to the Attorney General requested for advice as it sought to “explore legally and constitutionally acceptable alternatives or complementary approaches on the form of mechanism that would enable the use of Collective action clauses (CAC) designed to allow a qualifying majority of bondholders to agree to debt operation terms on their bonds and make the resulting changes binding on dissenting creditors.”

As part of its options, the government also sought advice on “whether under the Ghanaian law, the executive action i.e executive instrument, emergency powers can be employed to impose CACs on bondholders.”

But in a response dated Friday, November 18, 2022, the Attorney General advised against such moves.

“The process of the government undertaking debt restructuring does not fall within the confines of articles 21 and 31 of the Constitution.

“Debt restructuring which may require the Government to vary terms of its bond agreements will not constitute an emergency situation permitting the President to invoke the emergency powers conferred upon him by the Constitution.”

The Attorney General, Godfred Yeboah Dame, further explained that “Even though Governments are entitled to issue executive instruments or to take measures, as provided in Act 982 to address issues of unforeseen economic shocks, doing so to impose CACs on bondholders may amount to a unilateral modification of a bond agreement which is also the product of the exercise of an executive action of government in its commercial capacity.”

The A-G thus asked the government to engage bondholders and relevant parties to arrive at a voluntary agreement in order to make a debt restructuring programme successful.

Meanwhile, the government of Ghana has since gone ahead to invite domestic bondholders to sign up for a new debt exchange programme on their bonds.

As part of the new programme, the Minister for Finance, Ken Ofori-Atta has announced that domestic bondholders will be made to exchange their bonds for new ones at new interest rates.

Read the A-G’s full legal advise below:

Find portions of the legal opinion of the AG on the debt exchange programme below:

Source: www.ghanaweb.com

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoRoad Safety Authority narrates how buttocks causes road accident

-

GENERAL NEWS4 weeks ago

GENERAL NEWS4 weeks agoWhy 15 police officers stormed Owusu Bempah’s church – Kumchacha narrates

-

GENERAL NEWS3 weeks ago

GENERAL NEWS3 weeks agoWatch how Ibrahim Mahama rode Honda superbike to pay last respects to late friend

-

GENERAL NEWS4 weeks ago

GENERAL NEWS4 weeks agoHow Offinso residents storm destooled queen mother’s house, demand for new chief

-

South Africa News4 weeks ago

South Africa News4 weeks agoWoman thrown out of a speeding taxi while on her way to work

-

GENERAL NEWS5 days ago

GENERAL NEWS5 days agoDeadly clash between youth and navy personnel results in two deaths at Tema Manhean

-

SHOWBIZ KONKONSAH6 days ago

SHOWBIZ KONKONSAH6 days agoJunior Pope’s Death: Video of John Dumelo refusing to join canoe for movie shoot over safety concerns resurfaces

-

News Africa1 month ago

News Africa1 month ago‘Satanically dubious’ – SCOAN releases statement on BBC’s report about TB Joshua, church