Finance

GRA targets GH¢2.7 billion from ‘social media tax’

GRA sets GH¢80.3 billion revenue target for 2022

Ghana needs to benefits from social media giants, GRA Commissioner

The Ghana Revenue Authority is targeting a revenue collection of GH¢2.7 billion from a ‘social media tax’ aimed at widening the country’s tax net, a Graphic Business report has said.

According to a Commissioner for the Domestic Tax Revenue Division at the Authority, Edward Appenteng Gyamerah, out of the total amount, his outfit hopes to collect GH¢1.7 billion from betting and gaming companies while GH¢1 billion will be generated from social media companies.

The GRA Commissioner speaking with the portal explained the move is necessary to ensure that country benefits from these social media giants which often operate outside the country.

“As I speak, we have developed a system to track the activities of non-resident persons and institutions that are using our space to do business.”

“We have also had interactions with Google, Netflix and all these businesses that operate in the space and some of them have already requested to register so that they can start complying,” the Commissioner of Domestic Tax Division is quoted by Graphic Business.

Edward Gyamerah further said the coronavirus pandemic exposed the huge revenue potential in the e-commerce, betting and gaming industry and it is for this reason the GRA is rolling out a comprehensive policy to boost the country’s revenue through the tax regime.

“The GRA has concluded consultations and sensitisation with the key players on the new regime, and this had led to some companies beginning to register their companies as part of compliance,” he notes.

Meanwhile, the taxing of gaming, betting and e-commerce businesses was meant to take off in 2021 failed to move ahead due some circumstances.

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoRoad Safety Authority narrates how buttocks causes road accident

-

GENERAL NEWS1 month ago

GENERAL NEWS1 month agoWhy 15 police officers stormed Owusu Bempah’s church – Kumchacha narrates

-

GENERAL NEWS3 weeks ago

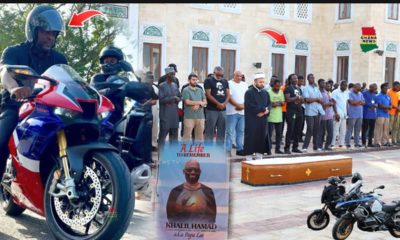

GENERAL NEWS3 weeks agoWatch how Ibrahim Mahama rode Honda superbike to pay last respects to late friend

-

GENERAL NEWS4 weeks ago

GENERAL NEWS4 weeks agoHow Offinso residents storm destooled queen mother’s house, demand for new chief

-

South Africa News4 weeks ago

South Africa News4 weeks agoWoman thrown out of a speeding taxi while on her way to work

-

GENERAL NEWS6 days ago

GENERAL NEWS6 days agoDeadly clash between youth and navy personnel results in two deaths at Tema Manhean

-

SHOWBIZ KONKONSAH1 week ago

SHOWBIZ KONKONSAH1 week agoJunior Pope’s Death: Video of John Dumelo refusing to join canoe for movie shoot over safety concerns resurfaces

-

News Africa2 months ago

News Africa2 months ago‘Satanically dubious’ – SCOAN releases statement on BBC’s report about TB Joshua, church