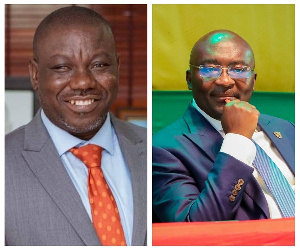

Governor of the Bank of Ghana (BOG), Dr Johnson Asiama, has raised concern over continued dollarisation of the economy despite recent stability in the Ghanaian Cedi. Speaking at the Graphic Business/Stanbic breakfast meeting in Accra on the theme “Sustaining forex gains: Business and economic impact,” he urged local businesses to transact in Cedis within Ghana’s borders.

“We are still grappling with the deep-rooted culture of dollarisation. Too many businesses continue to price in dollars, in real estate, education, and luxury retail, despite transacting entirely within Ghana.

“This practice not only violates legal tender laws but also undermines confidence in the Cedi,” he said. Dr Asiama also warned against the limited reinvestment of foreign exchange earnings. “Even more concerning is the mismatch between forex inflows and domestic reinvestment.

“Export receipts have risen but the significant portion is either held offshore or not channelled back into productive activities at home,” he noted. Dr Asiama identified commodity dependence and behavioural practices as major obstacles to sustained transformation.

He explained that Ghana’s current account and reserve trends remained heavily dependent on exports of gold, cocoa, and oil, making the economy highly vulnerable to price fluctuations beyond the country’s control. “Gold prices, which have significantly boosted our export earnings, are currently above US$3,200 per ounce, influenced by geopolitical uncertainty, including the recent Iran-Israel conflict. While beneficial for now, a future correction in prices could quickly narrow our trade surplus,” he stated.

Dr Asiama acknowledged policy trade-offs in currency management, stating that excessive appreciation could reduce export competitiveness and slow industrial recovery. He said the central bank was walking a delicate line in managing forex strength without overtightening liquidity, which could suppress private sector credit and stifle the growth the government sought to encourage.

Dr Asiama emphasised that stabilising the Cedi alone was insufficient; success depended on translating forex stability into broad economic transformation to empower businesses, create jobs, and enhance productive capacity.

“Let’s all base our projections, our perceptions, whatever it is, our thoughts, doubts, and our fears on the data. What does the data say? Not what the Alhaji says, not what the Zamrama man says,” he urged.

The Bank of Ghana, Dr Asiama noted, is introducing hedging programmes and rolling out the e-Cedi to integrate retail payments.

He said a regulatory framework was underway to bring cryptocurrency exchanges and digital asset platforms under formal oversight.

The Governor added that weekly economic policy coordinating meetings and enhanced exchange rate monitoring are being implemented to guide responsive economic decisions. He called on Small and Medium-sized Enterprises (SMEs) and the informal sector to improve savings rates and invest earnings locally.

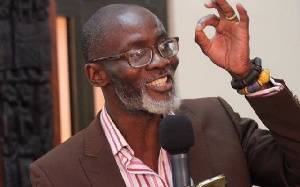

Board Chairman of the Securities and Exchange Commission (SEC), Dr Adu Anane-Antwi, called for policies to encourage foreign currency conversion into Cedi to promote a more stable foreign exchange market as seen in South Africa, Kenya, Ethiopia, and South Korea.

He called on Small and Medium-sized Enterprises (SMEs) and the informal sector to improve savings rates and invest earnings locally.

Dr Adu Anane-Antwi, Board Chairman, Securities and Exchange Commission (SEC) called for policies to encourage foreign currency conversion into Cedi to promote a more stable foreign exchange market as seen in South Africa, Kenya, Ethiopia, and South Korea.

SOURCE: GNA